All Stock markets & shares Articles

The value of shares around the world has sunk like a stone over the first few weeks of the year due to a worsening outlook in the US and the continued effects of the global credit squeeze. Chris Sleight reports.

After a tumultuous start to the year, stock markets around the world calmed down a little in late February and March. However, the mood remained nervous and shares generally continued to fall. Chris Sleight reports.

Share prices rebounded in April, as some confidence returned to the markets. There were some good increases in prices, but companies are generally still in negative territory for the year to date. Chris Sleight reports.

Share prices clawed back some ground in February following the disastrous start to 2008. But although there was some bounce it was by no means a recovery. Chris Sleight reports

The value of shares around the world has sunk like a stone over the first few weeks of the year due to a worsening outlook in the US and the continued effects of the global credit squeeze. Chris Sleight reports.

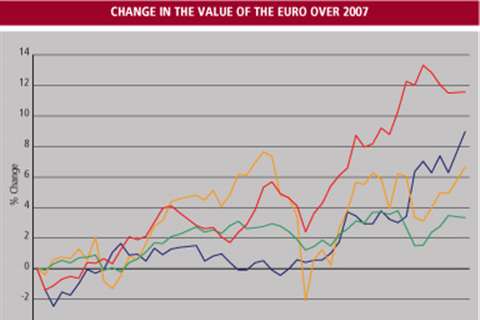

The stock markets had more ups and downs than usual in 2007, with record highs being followed by the fall-out from the credit crunch. There were some gains to be had, but it was still the most difficult year since 2002. Chris Sleight reports.

IRN's regular Rental Share Index, a monthly share price tracker of rental company shares.

Strabag SE, Austria's largest contractor, raised € 1.33 billion (US$ 1.91 billion) in its October Initial Public Offering (IPO) of shares.

Stock markets may not be as worried about the sub-prime crisis as they were a few months ago, but now the rising oil price is giving cause for alarm... again. Chris Sleight reports

November IC Share Index

partnercontentplaceholder

blockintro

partnercontentplaceholder

blockintro

partnercontentplaceholder

blockintro

partnercontentplaceholder

blockintro