Finance: 26 Feb - 26 March 2021

27 April 2021

March saw a slowing of growth across the CE indexes, but generally positive movement, nonetheless

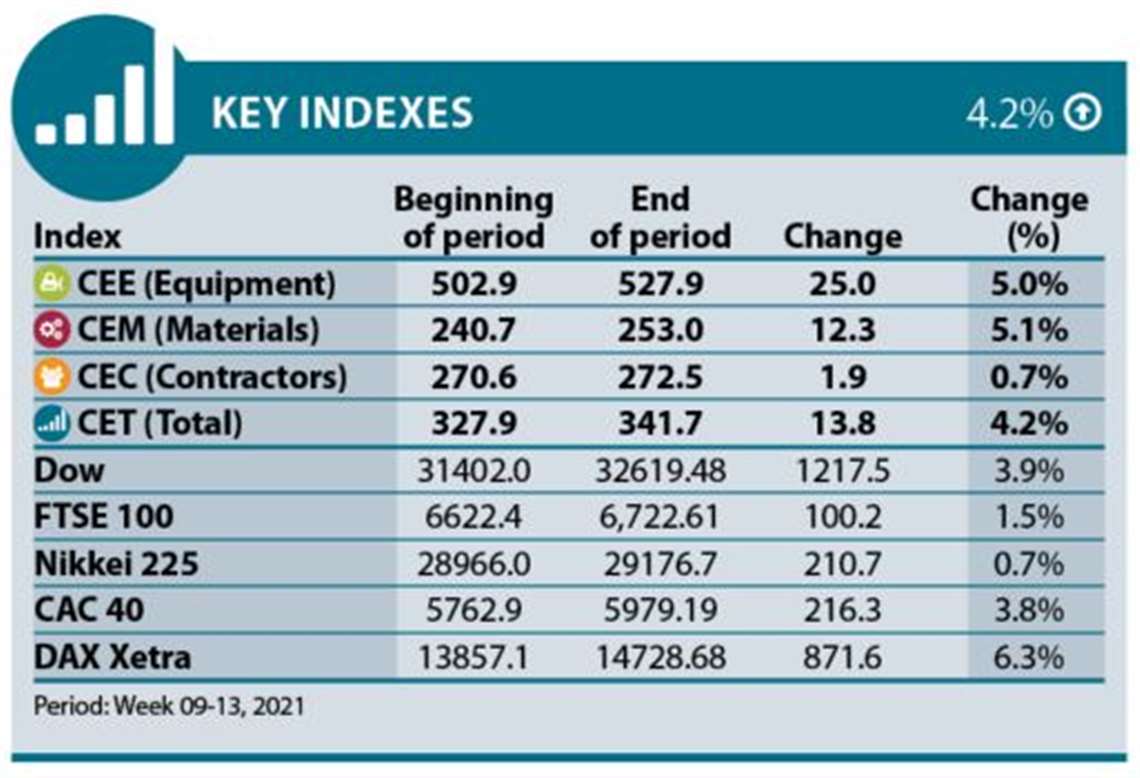

This article will assess the period for listed contractors, equipment manufacturers and material producers from week 9 to week 13 of 2021 (26 February to 26 March, 2021).

In total, our business indexes (equipment, materials and contractors), experienced growth in Marchof 10.8%. The materials index just outstripped equipment, with the two indexes rising by 5.1% and 5.0% respectively. Contractors, on the other hand, saw just 0.7% growth on average.

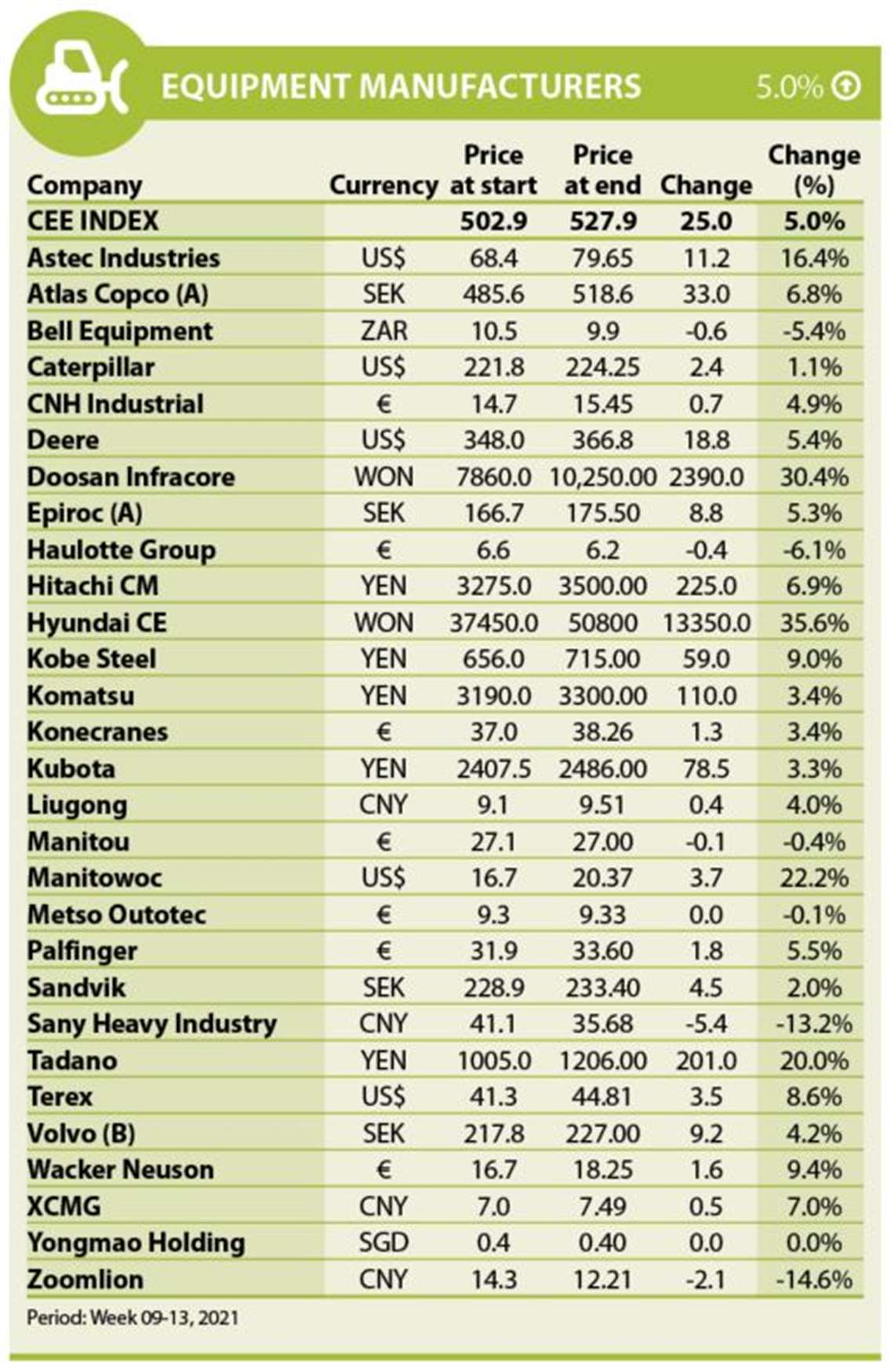

EQUIPMENT

Two Korean companies sat at the top of the equipment tree at the end of March. Hyundai Construction Equipment is in first position, with a positive move of 35.6%, while Doosan Infracore are close behind, rising 30.4% in our index.

We should not be surprised at these large jumps, given that Hyundai acquired a controlling interest in Infracore, with a €635 million acquisition in February.

Hyundai also made it clear that it had big plans for the company, saying the deal would be a springboard, propelling both Infracore and Hyundai to the highest levels within the global construction market.

Sitting third on the index is the US cranes manufacturer Manitowoc, with a healthy 22.2% rise, following last month’s very respectable rise of 14.3%. Although the company felt the impact of Covid-19, its fourth quarter results were very healthy, with an end-of-year backlog of approximately €460 million.

Propping up the index this month is the Chinese OEM Zoomlion (-14.6%), which sat in third position last month (21.9%), showing that a month can be a very long time in terms of a company’s attractiveness to investors.

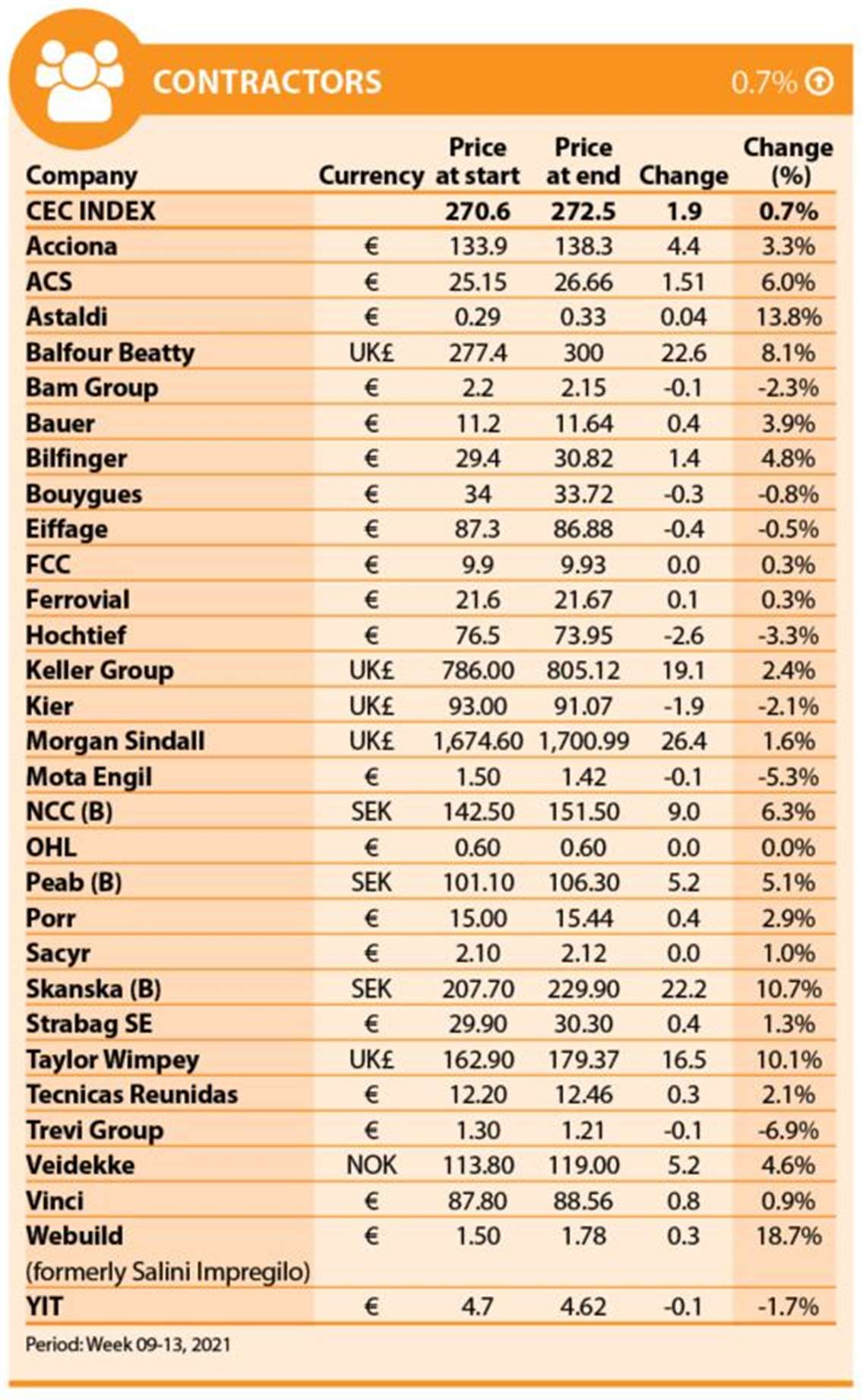

CONTRACTORS

With average growth of just 0.7% in the contractors index over the analysis period, one might think some companies had suffered major reversals, but only eight of the 29 companies in the index saw negative growth.

Of these, Italian ground engineering specialist Trevi Group was hit hardest, with a -6.9% fall from the previous month. Portugal’s largest contractor is also continuing to feel the effects of the pandemic. Its drop of -5.3% on the index follows the announcement of a -17% fall in sales in 2020, with its business at home – but even more so in Africa and Latin America – experiencing a severe slump.

At the other end of the index, Italian supergroup Webuild enjoyed an 18.7% rise, taking it to top spot. The growth comes soon after the company announced that it had secured not one but two billion-euro-plus rail projects in Italy.

Europe’s largest building company, Vinci, only managed to grow by 0.9%, but it will be interesting to see what happens next month, given that the company recently announced that it was acquiring the energy business of Spanish renewables specialist ACS for almost €5 billion.

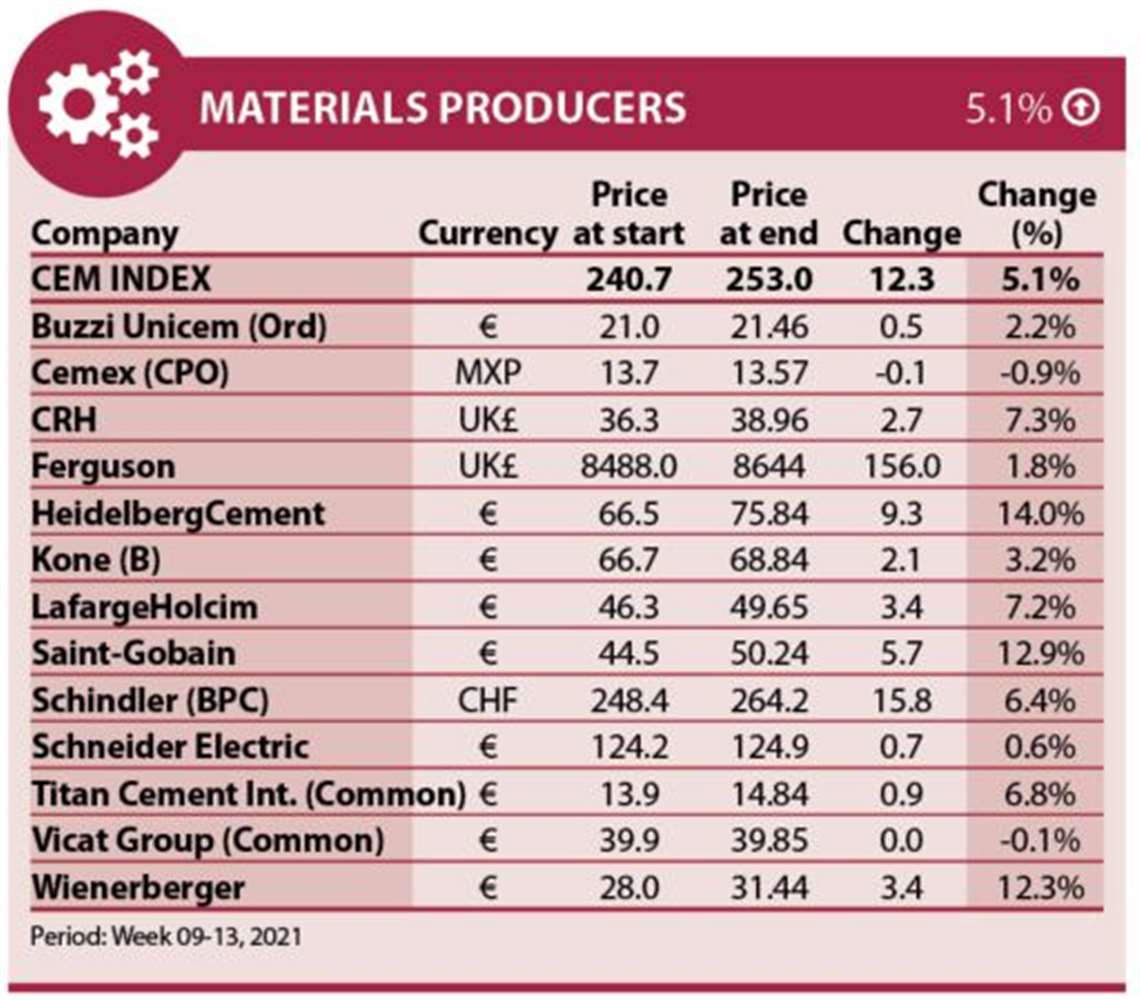

MATERIALS

With so much talk in the construction industry about the need to reduce emissions and to use more environmentally friendly building materials, it’s unquestionably a challenging and volatile time for materials producers.

Last month, for example, Mexican producer Cemex led the index with growth of 11.0%; this month, the company sits rock bottom, having experiences a fall of -0.9%.

Similarly, France’s Vicat Group, which rose 10.4% last month, to sit in second position, now sits second from bottom, following a 0.1% fall.

At the top of the materials index this month, Germany’s HeidelbergCement enjoyed a rise of 14.0%, following the announcement of its very healthy 2020 results.

The board approved a 5% increase on dividends, compared with the pre-Coronavirus year of 2018, while the chairman, Dr. Dominik von Achten, described the company’s flexibility and resilience, saying, “As a result, we were able to achieve top results in key figures despite an unprecedentedly difficult year.”

Other high achievers across the analysis period are France’s Saint-Gobain (12.9%) and Austria’s Wienerberger (12.3%).