Equipment market review: North America

10 January 2018

At some 158,000 machines sold, with a retail value of more than $26 billion, the North American construction equipment segment was the largest and most valuable regional market in the world in 2016. This year it is likely to be overtaken in volume terms by China. However, the higher machine specification in the US and Canada, partly but not wholly due to more stringent engine emission requirements, will still make it the most valuable market in the world.

In terms of the popularity of different types of equipment, North America shares some characteristics with other mature markets, but it also has some unique features all of its own.

First the common ground. As in Europe and Japan, crawler excavators, mini excavators and wheeled loaders are popular machines in North America. The region also shares some of Europe’s affinity for telescopic handlers, and these four machine categories represent some of the highest volume markets in North America.

However, there the similarities start to end. One of the unique features of the North American market is its love affair with the skid steer loader. Last year the region accounted for more than 75% of global sales of this type of machine, and it is also a vast market for compact tracked loaders.

Another quirk of the North American market is that backhoe loaders sell in reasonable numbers, whereas their popularity has waned in Europe over the last decade.

But one of the most striking features of the regional market is that despite being a developed region of the world, equipment for large-scale earthmoving still sells in significant numbers. It is the world’s largest dozer and grader market in volume terms – more so than China and other major emerging markets like India, where equipment such as this would be expected to be sold in large numbers for new-build infrastructure projects. North America is also by far the world’s largest articulated dump truck market, but the comparison to emerging markets cannot be made here as these machines have a very patchy appeal.

The key reason for this is North America’s sparseness, which means the region is still building outwards, rather than upwards, as is the case in Japan and much of Europe. This means that residential and non-residential construction often still involves a high element of earthmoving on virgin land, whereas in Europe and Japan it is often more of a high-rise or brownfield activity.

Growth forecast

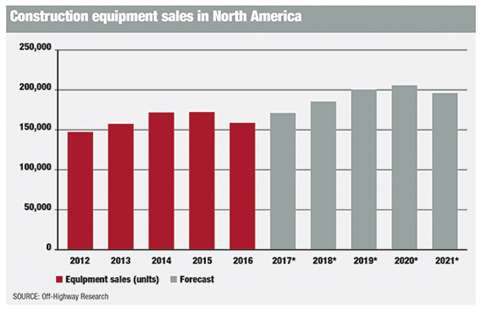

Off-Highway Research’s forecast for North America is that sales will grow to over 200,000 units by 2019 and 2020, taking the retail value of the market to more than $35 billion.

This is based on the premise that the economy will continue to grow at a reasonable pace, keeping construction output at good levels. It also assumes something of a recovery in global commodity prices, which will stimulate equipment sales to the North American mining, gas and oil segments.

A more difficult factor to weigh is President Trump’s promise to channel $1 trillion into US infrastructure investment. Assessing the impact of this on the equipment market raises questions about whether this total is achievable, over what timeframe it will be added and whether it would genuinely be ‘extra’ spending.

One way to look at this is that $1 trillion is equivalent to about one year of US construction output at current levels. So if this did materialise as genuine extra investment, it might stimulate a year of extra construction equipment sales over the life of the spending – around 150,000 units.

That is probably the most optimistic scenario, but it still holds true that extra infrastructure investment, or even just greater stability and predictability in funding, should stimulate equipment sales.