Rough terrain cranes: the strong survive

22 February 2021

The market might be tough but rough terrain cranes are built to withstand harsh conditions. Christian Shelton reports

When we last looked at the rough terrain (RT) crane sector, 12 months ago, the market was decidedly depressed with Link-Belt being the only large manufacturer to launch a new RT at the year’s biggest trade show, Bauma. This year, there’s good and bad news. The bad, you’ve guessed it, is Covid-19 which has disrupted all crane markets globally. The good news? There are still signs of positivity with new crane orders being fulfilled globally, new dealership announcements, range updates, and at least one new model launch.

The first units of US manufacturer Link-Belt’s new RT, the 110 tonne (120 US ton) capacity 120|RT, were delivered domestically and internationally in fourth quarter 2019. International shipments went to Jaidah Motors and Trading Co. in Doha, Qatar, and Civilia S.A. in Bogotá, Colombia.

A Link-Belt 120|RT at Ras Laffan Industrial City in Qatar, following its delivery to Link-Belt distributor Jaidah Motors

A Link-Belt 120|RT at Ras Laffan Industrial City in Qatar, following its delivery to Link-Belt distributor Jaidah Motors

The 120|RT, with its six-section 11.6 metre to 50 metre pin and latch formed boom, aims to meet demand for larger capacity rough terrain cranes. “The trend is growing towards larger capacity cranes,” says Kelly Fiechter, product manager rough terrain cranes at Link-Belt. “The 100 to 110 ton class is the most popular. Demand to work at radius, as well as up and over, continues to require higher capacity cranes.”

New model

At the other end of the market, Japanese crane manufacturer Kato Works has launched a 30 tonne capacity rough terrain crane, the SR-300LX, for the global market. The SR-300LX has a four-section hydraulic round boom that extends from 9.35 to 30.5 metres and a 13 metre super long luffing jib. Its 30 tonne capacity is available at a three metre radius. The maximum boom lifting height is 31.2 metres. The jib’s maximum lifting capacity is 3.5 tonnes at 75 degrees and the crane uses a Mitsubishi 6M60-TL engine.

Kato has launched the 30 tonne capacity SR-300LX for the global market

Kato has launched the 30 tonne capacity SR-300LX for the global market

Kato says the operator’s cab has an ergonomic design with a joystick lever, an armrest, seat suspension, and an adjustable sunshade. An ACS (Automatic Crane System) includes an automatic safety control that responds to any unexpected changes in operating configurations, while a range of limiting functions are designed to increase safety during operation. The ACS has a colour LCD and illustrated key switches for fast identification of operation functions.

The crane can be specified with a winch view camera, ACS outside indicator, a slewing warning buzzer, a fan, an AM/FM radio, a fire extinguisher, a Kato Crane Operation Recorder (K-COR), and an anemometer.

The carrier can be specified with a spark arrester, a rear-view camera, and a right-hand side view camera.

Kato Works has also made its 51 tonne capacity SR-500LX (left hand drive) rough terrain crane available for the global market. First launched in October 2019, the model has a 42 metre boom and 13.7 metre super long luffing jib (EJIB). It is equipped with high resolution display ACS moment limiter with a K-COR data logger.

Mun Siong Engineering has the first SR-500LX in Singapore

Mun Siong Engineering has the first SR-500LX in Singapore

One of the first SR-500LX units was sold to Singapore-based construction and integrated maintenance solution provider Mun Siong Engineering by heavy lifting service provider and crane rental and sales firm Sin Heng Heavy Machinery. This was the first SR-500LX in Singapore.

Wheeler dealer

Terex Cranes has a new dealer for its rough terrain cranes covering Portugal and the islands of Cape Verde and São Tomé and Principe. Terex has appointed Portuguese company Auto Mecânica Alvorgense (AMA) as its RT dealer for these areas. The two companies have worked together previously. “AMA has a long history with the Terex portfolio,” said Guillaume Bertrand, Terex sales manager RT cranes. “We are confident their knowledge about these markets will reinforce our market share and bring us new opportunities.”

Terex appoints AMA as its RT dealer

Terex appoints AMA as its RT dealer

Terex Cranes is also working with Mauritius-based machinery dealer Leal Equipements Cie (LEC) to provide the Mauritius, Madagascar and Seychelles markets with Terex rough terrain cranes, service support and parts. LEC has recently reinforced its market positioning, with additional business segments namely port, energy, crushing and screening, handling and warehousing with the aim of becoming a ‘one- stop shop solution provider’.

Terex Cranes has also welcomed Romania-based RET Utilaje to its growing dealer network. RET will offer Terex RTs across Romania.

Zoomlion says it has North American dealership opportunities as its ZRT850 will have arrived in the region by the end of the year. Zoomlion enjoyed success with the ZRT850 in the Middle East following its display at Bauma 2019, selling 47 ZRT850s worth nearly US$14 million to one buyer.

Zoomlion’s ZRT850

Zoomlion’s ZRT850

The ZRT850 has a capacity of 85 tonnes and a five-section U-shaped boom that extends from 12 to 47 metres. It comes with two trussed fly jibs. The main boom offers a 49.8 metre maximum lifting height while the fly jibs give a 67.1 metre maximum lifting height and a 65.7 metre tip height. The crane has a new boom head and end structure with optimised boom connections designed to provide stronger load bearing capacities.

For crane rental companies looking to minimise transportation costs Switzerland-headquartered crane manufacturer Liebherr says its range of 90 and 100 tonne rough terrain cranes are in demand from the construction, oil and gas, mining, and wind energy sectors – with its busiest markets being North America and the Middle East. Liebherr also reports increased demand from customers in Russia and Europe.

Liebherr says it generally prefers making two-axle RT cranes instead of three-axles, as this makes the machine more manoeuvrable. For improved transportation logistics in some US states it offers an 80 US ton version of the LRT 1090-2.1 which can operate with only one transportation unit.

Japanese crane manufacturer Tadano reports that, despite the global decline in demand for cranes due to the effects of coronavirus, demand for its RTs remains strong. In North America, it has seen increased demand for RTs with larger lifting capacities. One reason for this, it believes, is because of the increased size of suspended loads in factories combined with users looking to improve safety by ensuring performance margins.

Tadano’s latest rough terrain models are the GR-1000XLL-4, GR-1000XL-4, and GR-800XL-4 for the North American market. For other markets, it has the GR-1000EX-4, GR-900EX-4, and GR-700EX-4 – which, including the GR-1000XL-4, are the first Tadano products to be equipped with the new ‘Smart Counterweight’ feature.

A cab tilting mechanism is now available for Tadano rough terrains

A cab tilting mechanism is now available for Tadano rough terrains

Moving the counterweight further to the rear can increase the lifting capacity by up to about 20 percent, the company claims. Tadano RTs also have a new crane cab with a colour touch panel display and a cab tilting mechanism. A new ‘Automatic Pump Disconnect’ function stops the hydraulic pump when the crane isn’t being operated which helps to reduce fuel consumption.

A winch drum camera for checking the state of the wire rope during crane operation now comes as standard. The GR-1000XLL-4, GR-1000XL-4, and GR-800XL-4 for the North American market have a right-front camera and a rear camera to enhance safety during travel operation.

These models are the first to come with Clearance Sonar which detects obstacles behind the vehicle and notifies the operator with a buzzer.

Oil and gas revival

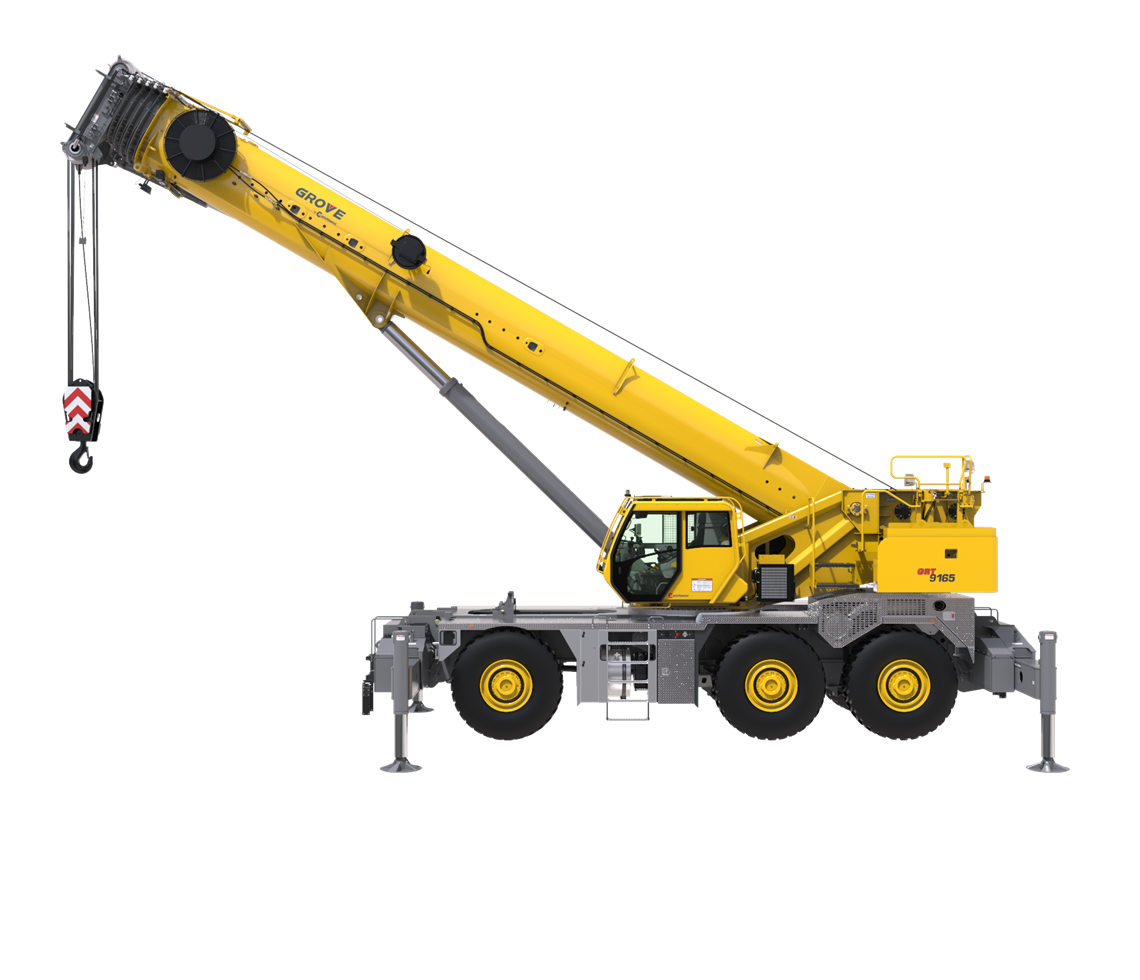

The revival of the oil and gas sector in Brazil is identified by crane manufacturer Manitowoc as boosting demand for RTs. The company has just sold one unit of its largest capacity RT, the Grove GRT9165, to Brazilian company Transdata Engenharia e Movimentação (TEM) – which specialises in complex handling and lifting operations for some of the country’s largest industrial segments, including refineries, wind farms, hydroelectric plants, steel mills, and mining operations.

The first Grove GRT9165 in Brazil goes to TEM

The first Grove GRT9165 in Brazil goes to TEM

The crane is the first of its kind to go to Brazil and it will be used for supply and maintenance operations to support offshore oil platforms in the state of Rio de Janeiro. It was delivered directly to an offshore support base in Niterói in February 2020, where it will remain for two years. It will be used exclusively by a TEM customer that specialises in supply and maintenance support for offshore platforms and other oil and gas infrastructure.

Manitowoc has also announced that, due to the popularity of its Maxbase outrigger positioning system on its other crane types, it is extending the technology into its Grove rough terrain cranes. Maxbase is designed to allow positioning of outriggers in many configurations, including asymmetric layouts, so the operator can maximise capacity in the space available.

Testing is underway to equip the Grove GRT8120 as the first RT crane model to feature Maxbase. “With Maxbase, users know they are lifting to the maximum possible capability of the crane in that configuration,” says John Bair, Manitowoc product manager for RT cranes. “This allows users to increase utilisation and lower overall project costs.

“With rough terrain cranes serving so many different types of applications and being used all over the world in various climates and conditions, it’s important to provide customers with the highest quality so they can feel comfortable knowing their crane will be reliable in the field under any condition,” concludes Bair.

This inherent toughness and the consequent versatility of RTs will always be sought after by particular industries and for use in certain locations.

A revival in existing oil and gas markets combined with manufacturers actively working to expand their sales territories, means the sector looks likely to remain strong, no matter how tough the global market conditions become.

Mammoet has around 340 rough terrains

Mammoet has around 340 rough terrains

Heavy lifting and transport services provider Mammoet has around 340 RT cranes in its fleet around the world. The bulk of these are in the 75 tonne and 100 tonne capacities, although Mammoet notes that its larger 130 tonne and 160 tonne class rough terrains are becoming more popular.

Mammoet’s RT fleet is distributed globally, with hubs in North America, the Middle East, and Africa. “We don’t really move these cranes around the world,” explains Peter van Oostrom, director global projects and assets, Mammoet. “They are a commodity and moving them around is expensive, especially if this is done for shorter term projects.”

Van Oostrom attributes the popularity of rough terrains in some regions compared to others down to a range of factors including the type of work, such as on project sites, environmental conditions and even road regulations.

Johnson Arabia displays some of its ten new Grove RT550Es, which can each lift up to 45 tonnes

Johnson Arabia displays some of its ten new Grove RT550Es, which can each lift up to 45 tonnes

Middle East crane and access equipment company Johnson Arabia has added ten new Grove RT550Es, manufactured by Wisconsin, United States-headquartered crane manufacturer Manitowoc, to its fleet in a move designed to target the oil, gas and urban construction sectors.

Johnson Arabia says, despite a slump in the first quarter of 2020, the longer-term fortune of the oil and gas sector in the UAE looks promising due to new exploration efforts to unearth resources. Natural gas has become a key strategic priority in the UAE, it says, and a string of new investments are planned to further develop its large gas resources and to meet rising domestic consumption.

“The Grove RT 550E fits our needs for this market perfectly,” says Martin Kirby, Johnson Arabia managing director. “Its compact design, higher lifting capabilities and manoeuvrability in tight spaces makes it a versatile crane for the UAE market for oil and gas projects and urban development where space is limited.”

The Grove RT550E can lift up to 45 tonnes and measures 11.7 metres long, 2.53 metres wide and has a six metre footprint. Johnson Arabia also points out that, being under 29 tonnes in weight, it meets heavy machinery regulations for suitable offshore work.