Russia’s mortgage boom

11 October 2018

The residential market in Russia will be the driving force behind the country’s entire construction sector in the long term thanks to the continued high demand of most of the country’s population for improving their housing conditions.

A report from Macon Realty Group said that mortgage loans, the most common means of purchasing homes in Russia in recent years, had finally strengthened, compensating for the crisis years of 2015 to 2016 in Russia.

Macon is the Russian member of EECFA (Eastern European Construction Forecasting Association) which conducts research on the construction markets of eight Eastern European countries.

Andrey Vakulenko of Macon said that as there had been a major drop in the population’s income, which was persisting, mortgage lending was the only way to increase home purchases.

He said, “The mortgage market easily overcame the crisis of 2015 to 2016 in Russia, and already in 2017 exceeded the peak indicators of the pre-crisis year of 2014.

“During the first half of 2018, the trend towards growth further strengthened – the volume of issued mortgage loans rose by 68%, and its share in the total number of housing transactions reached a record 54% in the primary market. All this shows the current high demand for mortgage loans.”

Explosive growth

It was said that to explain the explosive growth in mortgage lending, the fundamental factors shaping the housing market needed to be considered. These are the level of individuals’ living space provision; demand for housing (how much more housing needs to be built, so that the level of living space provision can reach an acceptable value – about 30m2); and affordability of housing for purchase (the ratio of the income of buyers and the price of real estate).

Macon quoted the Federal State Statistics Service of the Russian Federation, which said that to date, the total housing stock in Russia was about 3.4 billion m2.

Macon said this was only slightly more than 23m2 per person in terms of the country’s permanent population –146.9 million at January 1, 2018.

It added that this level could be considered low compared to most developed foreign countries, with 39m2/person in France and Germany; 70m2/person in the US, 76m2/person in Canada.

“Minimally comfortable living conditions are achieved with a security level of at least 30m2/person as per the social standards of the United Nations, and it is the target of public housing programmes in Russia.

“To ensure that the population’s living space has reached this target, while maintaining the country’s population at the current level, another 1.0 billion m2 of living space should be built. Thus, the low level of housing provision is the guarantor of the preservation of demand for new housing projects for a long term,” said Macon.

Existing housing stock

The second factor ensuring long-term demand for housing was said to be the quality of the existing housing stock, which features more than 33% (or about 1.2 billion m2) of housing built before 1970.

Even with the record volumes of housing construction registered in Russia in recent years – about 80 million m2 annually in 2014 to 2017 – and even if it remains at the current level, it was estimated that it would still take at least 28 years to reach the minimum acceptable security, and fully to replace the old housing stock.

In general, said Vakulenko, housing demand in Russia would not be satisfied in the next two or three decades, but it was now especially acute.

“The low level of security and dilapidation of a large part of the housing stock create uncomfortable conditions for the lives of many Russians.”

He said that today, about 45% of Russian families wanted to improve their housing conditions, according to a study conducted by DOM.RF, the Agency for Housing Mortgage Lending.

Only about 12 million families in Russia were said to be planning to purchase housing in the next five years, according to a survey conducted by the Russian Public Opinion Research Centre in 2017.

“If we translate this into residential area,” said Vakulenko, “it is a potential demand for 665 million m2 of housing (evaluation by DOM.RF). However, this demand will never be realised if housing is not affordable to individuals.

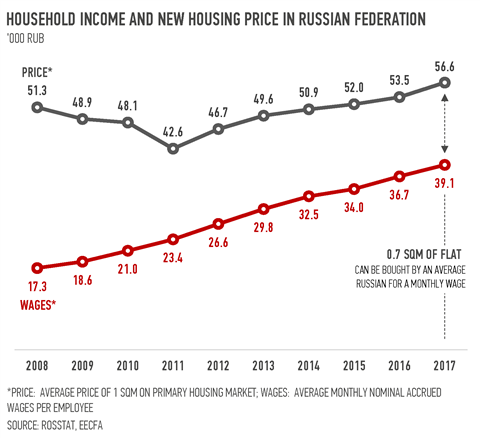

“The affordability indicator is determined by the ratio of the income level of individuals and housing prices. In fact, the average availability of housing in recent years has not changed significantly, remaining at a fairly low level – the growth of nominal incomes occurred in proportion to the rise in housing costs – and in these circumstances, the actual opportunity to purchase own housing in Russia is directly dependent on the availability of mortgage lending.”

Besides the low affordability of housing and high housing demand, the driver of the Russian mortgage market growth was said to be a steady negative dynamic in mortgage rates. This year rates continued to decline and in the first seven months their average level was 9.6%. By the end of 2018, it is thought that it was likely to reach 9.0%.

Macon said that in the next few years, the most likely scenario for mortgage lending in Russia was a continuing rise in volume indicators. It said the positive dynamics would contribute to the increased availability of mortgages associated with the projected rise in real income as a result of an ongoing reduction of interest rates on mortgage products.

Around 8.6 million families are said to be planning to buy homes by taking a mortgage, and demand for mortgage loans in a five-year perspective is RUB20 trillion (€260.8 billion) according to DOM.RF.

“All this, of course, will support housing construction, which is one of the most capacious construction segments in Russia,” said Vakulenko.