Feature: Loxam acquires Lavendon, was it a good deal?

09 May 2017

French rental company Loxam Group announced on 20 February this year that it had acquired Lavendon Group for £2.70 (€3.18) per share, after bidding against TVH, which pulled out a month earlier. Was this a good deal for Loxam, what were the price and EBITDA multiple, and what does it mean for the industry going forward?

Paris-based Loxam was Europe’s largest equipment rental company even before acquiring Lavendon, having bought the rental businesses from Hertz and Hune.

What was the EBITDA multiple of this transaction?

Most rental company valuations and acquisitions use the enterprise value/EBITDA multiplier calculation to compare companies with different depreciation policies and debt structures.

EBITDA is earnings before interest, taxes, depreciation and amortization. Simply put, this is the cash a rental business generates before paying debt. The enterprise value is the value of the target company shares plus the target company’s own debt. The EBITDA multiplier is the enterprise value divided by the EBITDA (see table).

It is debatable whether to use Lavendon’s previous year EBITDA or current year EBITDA, or even the trailing 12 months. For Lavendon, we can’t see the monthly EBITDA, so 2015 actuals and 2016 estimates are included.

Using the information available, we see the value of the shares on 21 October, before any bidding or rumours, then at the first TVH offer of £2.05 (€2.42) per share, compared to the final £2.70 (€3.18) from Loxam. To this, we add Lavendon’s own debt from their third quarter report, compared to either the last full year EBITDA (2015) or the estimated 2016. The EBITDA multiple started at 4.27x (estimated 2016) and went up to 6.83x (estimated 2016).

|

Oct 2016 |

TVH offer |

Loxam offer |

Notes/Source |

|

|

Lavendon Shares outstanding |

€200.30 million |

€200.30 million |

€200.30 million |

Lavendon 2015 annual report |

|

share price offer |

€1.58 |

€2.42 |

€3.18 |

See text for dates |

|

cash offer price for shares |

€267.90 million |

€410.62 million |

€540.82 million |

Loxam and Lavendon press releases |

|

Lavendon annual EBITDA |

€106.39 million |

€106.39 million |

€106.39 million |

Lavendon 2015 report, plus estimate 2016 |

|

Lavendon Debt |

€186.17 million |

€186.17 million |

€186.17 million |

Third quarter Lavendon reports |

|

Enterprise Value |

€454.07 million |

€596.79 million |

€726.99 million |

Share value plus debt |

|

Enterprise Value/EBITDA |

4.27 x |

5.61 |

6.83 |

Calculated |

Is 7x EBITDA the new multiplier for the European rental industry?

Many rental company acquisitions during the pre-2008 boom were 6x EBITDA or above. There are reasons it was higher or lower, such as high growth or strategic market position. There was, and still is a significant discount for private companies compared to those publicly traded. But during boom times, bidding always seemed to begin at 6x EBITDA.

Post-2008 financial crisis, acquisitions were less frequent, many multiples were lower or not disclosed at all. Lavendon’s own EBITDA multiple was often between 4 and 5x EBITDA, as it was in October 2016 when the share price was £1.34 (€1.58). And as market leader in several European and Middle Eastern markets, plus being publicly traded, with some growth, it was one of the benchmark multipliers for the European rental industry. Many negotiations on company valuation included ‘Why should a given company have a higher EBITDA multiple than Lavendon, at today’s share price?’

How does the 7x multiple Loxam paid for Lavendon compare to valuations of its peers?

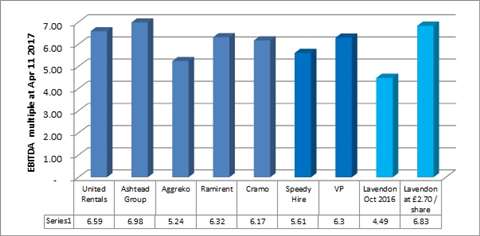

Looking at the other large rental companies whose shares are publicly traded, as of April 2017, Lavendon looked like a bargain last year, at £1.34 (€1.58) per share. Even up to £2.70 (€3.18) per share and at 7x EBITDA, the multiple compares reasonably to Ashtead and United Rentals. The numbers in the graph below are a mix of 2016 EBITDA and 2017 Market Cap and EBITDA and debt depending on when companies report, but the illustration is hopefully useful.

Why would Loxam pay more for Lavendon than its relatively steady £1.34 (€1.58) October 2016 share price?

The first answer is synergies.

Lavendon and Loxam operate in several of the same markets, including the UK, Germany, France, and Belgium. The combined company can save many millions of Euros in duplicated head office overheads, and overlapping depot networks. The Middle East was Lavendon’s most profitable region, where Loxam had no presence, and is a market for used equipment, potentially from Loxam’s other markets. Loxam has multiple categories of equipment in different markets, and may cross-sell. For example, it may rent generators via existing Lavendon depots in Saudi Arabia, or get into event rental in the United Kingdom.

United Rentals recently acquired NES in the US, and made special emphasis in its investor presentation that US$40 million (€37.59 million) of identified annual cost synergies expected to be realised by end of year two. US$40 million (€37.59 million) is 11% NES 2016 revenue of US$369 million (€346.72 million), or 26% of the EBITDA of US$155 million (€145.64 million). In this case, the synergies, plus US$35 million (€32.89 million) of cross-selling opportunities of other products to NES customers, would alone pay for the US$965 million (€906.74 million) cost of the company in 13 years. No doubt Loxam has done similar calculations, but as they are a private company they do not have to show them outside their inner circle of investors and bankers.

The second answer is timing.

Arguably the US construction recovery began earlier, and with more speed, than in many European countries. This is reflected in higher EBITDA percent to revenue for United and Ashtead compared to the Europeans. The market may look back on this moment as the start of another golden age of rental in Europe.

The third answer is savings.

The cost for Lavendon of maintaining a London Stock Exchange listing, with the advisory fees, legal fees, more detailed audits, disclosures, quarterly or half yearly investor roadshows and the resulting management distraction can usually be quantified in the millions of euros.

Lavendon produced a costly annual report of over 120 pages including audit committee, remuneration committee, and nominations committee reports. Competitors were also able to read the Lavendon annual reports and disclosures of how much acquisitions cost, and which markets are most profitable.

How do Loxam’s financials look post acquisition?

The simple answer is that it’s not so easy to see. The last numbers for Loxam SA in the French company registry are from December 2015 and show €658 million of revenue, plus shareholders’ equity of €612 million, and financial liabilities of €1.07 billion.

However, it can be misleading to start comparing these numbers Loxam’s publicly traded peers, since for private companies rarely can the entire story be seen from accounts published in registries. For example, the Loxam acquisition of Hertz France and Spain equipment rental business was completed in October 2015, so all the debt would be on the balance sheet but with just a few months of revenue and EBITDA.

Loxam stated 2015 proforma revenue for 2015 is US$897 million (€842.85 million), and with the Lavendon revenue it will be €1.35 billion. Proforma revenue signifies the number ‘as if’ the business had been acquired and been inside the group for an entire year.

For the debt, adding €726 million (Lavendon enterprise value including debt) to the €1.1 billion from 2015 would total €1.8 billion. This sounds high but compared to the likely EBITDA annual run rate of say, US$470 million (€441.63 million) – using Lavendon’s 2015 34.5% of revenue – the debt would be 3.81x EBITDA. This ratio is not low but not frightening either.

In 2011, 3i and Pragma Capital invested €60 million of capital to strengthen Loxam’s balance sheet, certainly Loxam is more investible than ever, for additional private equity or an initial public offering on a stock market.

In conclusion, Loxam paying almost 7x EBITDA for Lavendon looks high at first glance, but not so high compared to the valuations of its European and American peers. With Lavendon’s market position, if Loxam can achieve the operational synergies and head office savings, and if the timing is right and the business continues to grow, the acquisition will be remembered as a success.

Jeff Eisenberg

Jeff Eisenberg has been in the equipment rental industry since the mid-1990s, when he established Genie Financial Services. Since 2000 his roles include rental company director, shareholder, advisor, consultant and even equipment operator. His Claremont Consulting business advises financial institutions, investors and rental companies. jeff@claremont-consulting.com +44 7900 916933