JLG’s plan to meet ‘tremendous demand’

30 May 2023

As JLG’s backlog grows, so does its manufacturing footprint and capacities. Lindsey Anderson sits down with JLG’s Frank Nerenhausen and Tim Morris for an update

A somewhat-broken replacement cycle that’s seen fleets age well-past their due date. Mega projects and infrastructure work that will pump billions into construction for years to come. New technology, equipment electrification, partnerships and acquisitions. To say the market is “favorable” might be an understatement.

“We have a real healthy, well-balanced industry out there right now with potential multi-year growth,” Frank Nerenhausen, president of JLG, recently told ALH. “There are a number of external influencers that are driving tremendous demand.”

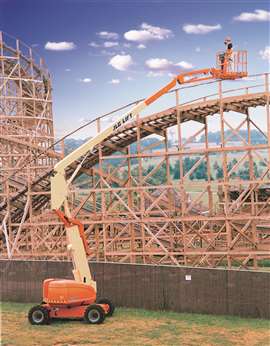

(Photo: JLG)

(Photo: JLG)

Nerenhuasen’s comments were from March – two months before JLG would announce record-breaking telehandler and aerials sales for its first quarter – when I had sat down with him and JLG’s Tim Morris for an exclusive, in-person update during ConExpo.

Tim Morris, senior VP of sales, marketing and custom support, JLG. (Photo: JLG)

Tim Morris, senior VP of sales, marketing and custom support, JLG. (Photo: JLG)

Frank Nerenhausen, president, JLG. (Photo: JLG)

Frank Nerenhausen, president, JLG. (Photo: JLG)

“After managing businesses through many cycles now, this one is really unique,” Nerenhausen said. “I do think some sectors are already in recession, but this one’s different because there’s a number of external influencers that the word ‘recession’ isn’t frightening our segment or our business.”

The “external influencers” Nerenhausen references – the Inflation Reduction Act, Infrastructure Bill, mega projects and onshoring of business – are not only aplenty, but massive, both in terms of spend and duration.

“All of this,” Nerenhausen adds, “is driving tremendous demand.”

Access equipment and telehandler sales skyrocket

In early May, JLG announced solid first quarter results – aerials sales were up 37% to $602 million while telehandlers saw a 49% increase over the same period last year to $341.4 million.

To meet the demand, JLG said it will transition 500,000 square feet of its manufacturing facility in Jefferson City, TN to produce additional telehandlers, which will also open up additional manufacturing capacities at the OEM’s McConnellsburg, PA plant.

Nerenhausen attributed these bumps to North America’s response following the global pandemic and related supply chain and materials pricing problems. “North America ramped much faster than the rest of the world,” he said. “So we diverted some of the production capacity from China for the Pacific Rim into Europe and South America so that we could focus North America capacity on North America. Now going forward, we will open up a new facility in Tennessee. It’s brownfield, already operational, and it will allow us to increase our capacity in telehandlers by 50%.”

Speaking to this increase in telehandler manufacturing capacities, Oshkosh Corp. President and CEO John Pfeifer said positive metrics alongside mega projects and infrastructure work are having a significant, positive impact on demand for telehandlers and access equipment.

JLG announced it would add rotating telehandlers to its product line in late 2021. (Photo: JLG)

JLG announced it would add rotating telehandlers to its product line in late 2021. (Photo: JLG)

“We’re seeing continued growth in the telehandler market,” Pfeifer said. What’s happening is there’s a lot of new use cases being discovered for telehandlers, which is one of the reasons that we’re seeing all that growth. And we see this as one of the opportunities for us to continue to drive growth in our business. It’s really the entire market that we see continuing to do really well over multiple years ahead.”

Sourcing components during supply chain problems

For the first three months of 2023, JLG put $1.2 billion of orders on the books, attributing the uptick to aging fleets and how utilization rates are impacting sales positively.

“We talk to our customers regularly,” Nerenhausen said back in March. “We talk about their confidence in the amount of machines they need for new business, and the significant requirements for fleet replacement, which, frankly, we have underserved the market now for several years.”

When Nerenhausen says, “we,” he is referring to the industry as a whole; every business has felt the supply chain’s impact on equipment production and delivery over the last few years – it has been a (well-documented) storm everyone has weathered together. Yet in Q1, JLG benefitted from “better-than-expected shipments due to modestly improved supply chain conditions,” according to Pfeifer.

“While supply chain challenges remain, we are seeing progress with supplier on-time delivery metrics, as well as the many actions we have taken to improve throughput,” Pfeifer said.

Some of these actions have included dual sourcing suppliers, both within the U.S. and internationally, and in some cases, multi-sourcing beyond the dual. Bringing new parts, components and suppliers into the fold doesn’t happen overnight, though. “These things take a lot of engineering time to do the qualifications and investigations needed,” Nerenhausen explained. “Because the quality of the product that goes out the door is our top priority.”

At the time of our sit-down, JLG had roughly $300 million in new supply for use as needed. By the end of this year, they expect to have half a billion.

JLG’s SkyTrak 3013. (Photo: JLG)

JLG’s SkyTrak 3013. (Photo: JLG)

In line with the company’s expectations, Mike Pack, executive vice president and chief financial officer of Oshkosh, said the environments are definitely improving, though modestly.

“I think if you look specifically at the first quarter, typically what we see even in a normal supply chain environment is with holiday shutdowns of suppliers as well as weather, we tend to see some interruptions,” Pack noted. “So, we really view that the first quarter was going to be impacted from a volume perspective really more timing more so than anything.

“The good news is we didn’t see that. So, supply chain was quite resilient better than we expected in the quarter, again still well off of norms. So, what we’re seeing from a cadence perspective is that we would expect that revenue – that run rate in Q1 will really carry the next couple of quarters.”

But will the supply chain ever be what it once was?

“I think it can get back to where it was,” Nerenhausen said. “I just think it’s going to take more time and more communication. Tim and I are on supplier update calls once a month, trying to really bring them in closely to us to understand what’s happening in the business and give them the confidence to make those investments in the interim.”

A smarter, more efficient equipment rental industry

When we look back about a decade or so ago, the rental industry was in adjustment mode. Competition had been fierce, and the market was riding high, but everything that goes up, must eventually come down – and rental outfits across the country found themselves scrambling to adjust fleet sizes as a result of over-fleeting and a slowdown in the market.

Today, however, is a much different (rental) ball game; one that involves data, demand and key market metrics. But even with the facts and figures in place, are rental companies asking for more than they need?

“I don’t think there’s been any over-fleeting,” Morris said. “Rental companies are so sophisticated these days. They aren’t what they were 10 years ago.”

The industry today, he says, is much more logarithmic.

JLG announced it would add rotating telehandlers to its product line in late 2021. (Photo: JLG)

JLG announced it would add rotating telehandlers to its product line in late 2021. (Photo: JLG)

“It used to be that people would get [market] reports and say, ‘We have this much fleet, we need to replace this much and we think we’re going to need this much,’” Morris said. “But with access to all the data and information that we now have, it’s a lot more science-based.”

What’s in store for tomorrow?

Looking ahead, JLG is estimating its segment sales and operating margin to be in the range of $4.4 billion and 11.5%, respectively, both up from its prior estimates of sales and operating margin of $4.2 billion and 11% respectively. The improvement is driven largely by stronger first quarter volume than expected.

“We’re confident in the long-term outlook of the market,” Pfeifer said. “We continue to see healthy market conditions, and that will drive growth and be good for our customers.”

But will customers face additional price increases?

“It took us over a year to get to price-cost neutrality,” Nerenhausen said. “With five increases. Five.”

Yet JLG doesn’t expect to face the same level of volatility within the market as it did over the last few years.

“It’s more regulated,” Morris said. “But there is absolutely a possibility of some type of disruption, something we don’t foresee. And obviously we’re going to do whatever we have to do to make sure that the business is healthy, our customers are healthy, our suppliers are healthy – those ecosystems are really important to us.”

Nerenhausen added, “That’s what makes this North American system great. The customers are healthy and rental companies are healthy, so the OEMs should be healthy. And that just keeps innovation healthy. That’s what we’re striving towards. The greater good.”

And that greater good includes the future of JLG.

Telehandler sales soared for JLG during its first quarter results this year. (Photo: JLG)

Telehandler sales soared for JLG during its first quarter results this year. (Photo: JLG)

“What we’re looking at is expanding our aperture,” Nerenhausen said. “That can include new products within this space or new verticals where our products may cross over into different markets. We’re not ready to talk about those markets, but you’ll hear soon, I would say within the next two quarters.

“We’re not abandoning our lane, but we’ve developed the technology expertise capacity, and we’re excited.”

With a healthy order book on its shelves – and 2024’s not even fully open yet – JLG feels confident about the next year-plus.

“The only thing I would really add is projects,” Nerenhausen noted. “They’re all over the news – and it’s one thing to be in the news, but what’s reality?”

From independent rental companies to larger regional players and GCs across the board, one thing rings loud and true: the market positivity and upswing in activity are real. Add to that fleet requirements needing to be met and the end result is a robust, strong market moving forward.

“This is a unique situation we find ourselves in, and one I haven’t seen in the 10 years I’ve been leading JLG – and I don’t know if we’ve seen it for 30 years,” Nerenhausen said. “You’ve got a real healthy, well-balanced industry out there right now with multiyear potential luck. So, if we all just continue to act responsibly, and be responsibly as leaders of the industry, we can continue to have success for the foreseeable future.”

Telematics 2.0JLG will launch a fully redesigned IoT telematics platform, ClearSky Smart Fleet, later this year, the company has announced. Dubbing the system as a “true, two-way fleet management and machine interactivity” platform, the latest ClearSky solution has been redesigned from the ground-up with new “innovative elements” added to “transform the way customers work.” Key features include:

According to Ara Eckel, director of product management for JLG’s connected solutions, ClearSky Smart Fleet will be standard on most new machines produced later this year, and customers with existing JLG products can continue to use the legacy ClearSky program for their connected needs. Both platforms will be integrated into Online Express, JLG’s 24/7 e-Commerce site. The platform is expected to launch this Summer or Fall. “Telematics today can only do so much,” Eckel said. “ClearSky Smart Fleet reimagines what’s possible, paving the way to a new frontier for connectivity solutions in the industry. More than yet another singular piece of software, it’s built as a robust, constantly evolving IoT platform capable of delivering new functionality, new insights and new ways to run cost-effective operations.” According to reports, the platform will consist of computer hardware and a downloadable mobile app for two-way communication and tracking of equipment fleets and for linking together equipment fleets, namely, monitoring, analyzing, modifying, updating, linking, producing reports and issuing notifications relating to geographic location, productivity, service and fleet maintenance, system parameters, and life cycle management support of equipment. JLG’s new E18 vertical mast lifts will offer ClearSky Smart Fleet as an option, according to the company’s brochure. |