5 areas where Chinese Belt and Road engagement is expected to increase in 2023

07 February 2023

China’s financial investment and construction contracts via the Belt and Road Initiative (BRI), the world’s largest infrastructure programme, looks set to increase in 2023, with five key areas of focus.

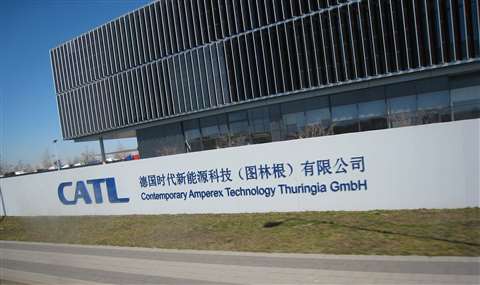

Battery producer CATL is building Europe’s second-largest gigafactory in Hungary under the BRI (Image: Giorno2, CC BY-SA 4.0/Wikimedia Commons)

Battery producer CATL is building Europe’s second-largest gigafactory in Hungary under the BRI (Image: Giorno2, CC BY-SA 4.0/Wikimedia Commons)

That’s according to a new report from Green Finance & Development Centre (GFDC), part of the Fanhai International School of Finance (FISF) at Fudan University, Shanghai, China.

The report found that BRI finance and investments were steady in 2022 US$67.8 billion, compared to US$68.7 billion in 2021.

The GFDC report said that a rebound in BRI engagement is “possible” in 2023, with the removal of covid-related travel restrictions, particularly for Chinese developers.

It predicted a focus on potential future engagements in five project types:

- Manufacturing in new technologies such as batteries for electric vehicles

- Trade-enabling infrastructure (including pipelines and roads)

- Information and Communications Technology (ICT), particularly data centres

- Resource-backed deals (such as mining, oil and gas)

- High-visibility or strategic projects (railway)

The emphasis on manufacturing in new technologies comes after strong engagement in the sector in 2022, including a $7.6 billion investment in battery producer CATL’s gigafactory in Hungary – the second largest of its kind in Europe.

Meanwhile, BRI engagement in energy-related projects dropped to $24.1 billion, the lowest level since the BRI began in 2013.

Shifting geography

Chinese BRI engagement saw a “significant slump” in sub-Saharan African countries in 2022, while other regions saw strong increases. Investments in East Asia rose 151% in 2022, with a 76% rise in construction contracts.

Investment in Middle Eastern countries also expanded, receiving about 23% of BRI engagement, up from 16.5% in 2021, and about 21% of Chinese investment volume, twice the share of 2021. Sub-Saharan Africa saw a 44% drop in construction and a 65% decline in investment compared to 2021. West Asia also saw falls in Chinese engagement.

Meanwhile 14 countries saw a 100% drop in BRI engagement compared to 2021, including: Russia, Angola, Sri Lanka, Nepal, and Peru.

Investment deal sizes increase while construction deals shrink

The average size of investment deals under the BRI increased from $444 million in 2021 to $650 million in 2022, the highest value since 2019. However, the investment deal size in 2022 was still 21% smaller than the peak in 2014.

For construction projects, the deal size in 2022 was the lowest since the BRI was announced in 2013, with an average of $321 million in 2022, compared to $496 million in 2021.

To read the full report, click here.