A powerful technology

21 February 2017

The average smart phone owner only uses about a third of the apps and features that are available on their devices according to a recent survey by Gartner.com. Smart phones offer hundreds of features that are never used – mainly because owners don’t know about them or how to use them.

For the most part, smart phone technology is ahead of the smart phone user. The same thing is going on with crane owners in the realm of telematics.

Today’s OEMs are equipping their cranes with telematics technology that allow owners to access myriad data about their cranes. And yet many owners don’t use this technology at all. Yet.While telematics systems are something North American crane owners are truly interested in, activation has been a slow process.

About 50 percent of Kobelco crane owners use the company’s in-house-designed telematics system, according to Jack Fendrick, president of Kobelco Cranes North America.

“The large contractors and national rental companies typically use these systems,” he said.Inquiries increaseTadano started installing telematics in its rough terrain cranes in 2008. Worldwide, there are nearly 10,000 telematics units installed on Tadano cranes in 60 countries with 60 to 70 percent of the company’s customers using telematics to manage their crane fleets. In North America about 33 percent of Tadano units have the company’s HelloNet telematics program installed. Tadano America’s Ingo Schiller envisions an increase in the need and usage of telematics and fleet management systems among crane owners.

“More customers are asking about telematics during the sales process, and our after-sales service teams are receiving more calls about installing telematics on older cranes,” said Schiller. “While all crane owners will benefit from the information available from telematics systems, different types of owners have a strong interest in different benefits. All of these groups are interested in the safety [aspects]. Construction companies ask more about the maintenance and asset management elements. Bare rental operations ask about location tracking and operating hours. Manned and maintained rental operations are interested in utilization and location tracking.”

John Alexander, director of GMK service, mobile training and telematics for Manitowoc Cranes, said his company has not seen a high increase in interest in telematics.

“At this time, I would say no, I don’t see an increasing need or usage,” said Alexander. “Telematics is still not widely adopted in the crane industry – unless we’re talking about locating and hours. Rental fleet personnel seem to have the most interest in the data, while only about 10 percent of our customers are really using the data on a monthly basis.”

Terex Cranes Global Marketing’s Erwann Maillot said Terex customers are looking for technologies that will help them do their jobs more efficiently.

“Terex Teleservice can be useful for all types of customers, regardless of their fleet size,” Maillot said. “Owners would be able to schedule the jobs of their cranes more efficiently, and would benefit more from uptime/maintenance management.” Maillot also noted that crane owners are still hesitant to actively use telematics technology because the value in comparison to the initial costs do not seem tangible. “Thus the increase of usage is still below expectations, but will further grow with ongoing penetration of IoT technologies in the day-to-day life,” he said. “Today, this technology is mainly used by larger rental fleets to continuously monitor their assets.”Ease of useLink-Belt’s Bruce Kabalen said that while usage of telematics systems is somewhat flat among crane owners, the users who do use Link-Belt’s telematics systems are pleased with the data they are getting, the productivity it offers and with the ease of the Link-Belt system.

“The true value of the telematics solution from a crane owner perspective is that you can perform predictive maintenance during down time so that you are always up during up times,” said Kabalen.

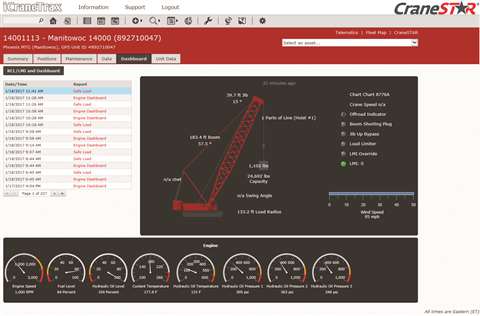

Link-Belt invested a lot of time and research into developing its telematics system and determined that outsourcing the system to A1A Software was the best solution for Link-Belt’s cranes and their owners. Link-Belt’s iCraneTrax powered by Pulse has been popular among certain segments of crane ownership.

“The large companies with huge crane fleets already have their own sophisticated fleet management systems,” said Kabalen. “But iCraneTrax brings the small to medium-sized player into the game, especially with our system and our partnership with A1A Software.”

Link-Belt is rolling out its new crane operating system, Pulse 2.0, which will offer two-way crane communication.

“This opens up a new game for customers, dealers and OEMs,” Kabalen said. “We will be able to do updates to the crane remotely. We will see a huge benefit with the new Pulse system. There won’t be a need to send a service truck 200 miles across Texas. You can flip a switch and the software update will fix the issue.”

Remote access is a game-changer, Schiller agreed.

“The customer can benefit from remote access to information about the crane and its performance while in their office or anywhere that the customer has access to the internet,” he said. “This information can be analyzed and presented to allow employees to make better business decisions. Some of the information that is available includes crane location, operating hours, component operating hours, error codes, lift parameters, fuel consumption and sensor data. Typical analysis and decisions made from this data include invoicing based on operation hours, efficient dispatching of equipment, intelligent maintenance based on component operating hours, predictive maintenance based on error codes and sensor data, safe crane operation based on lift parameters, asset management and location security from GPS data and remote troubleshooting based on error codes and Virtual Screen.”

Tadano has been pleased with the response from customers from its Virtual Screen.

“This allows remote monitoring and troubleshooting by a mechanic via an internet-connected computer,” he said. “Use of the Virtual Screen has allowed cranes to be brought back into operation without a mechanic having to attend to a crane in person, as well as allowed mechanics to troubleshoot the crane in advance of traveling to the job site to ensure that they arrived with the parts required to bring the crane back into service. All of this reduces the cost to the owner and means increased up-time of the crane.”

Fendrick said the main benefits are the true fleet management attributes.

“It allows them to analyze the pick history to determine if they need that big of a crane on that particular job site,” he said. “For example, if a contractor has a 160-ton crane on a given job, but needs that size unit on another job. They will look at the lift data and see if the crane is utilizing its full chart. If the crane is only picking 50 percent of the chart, then they can bring in a 110-ton size crane for that job and move the 160-ton crane where it is needed.”

Alexander said Manitowoc customers are interested in tracking hours of use.

“Other benefits include job site conditions, such as wind data and fault codes for service work,” he said.

Telematics data can greatly improve a crane owner’s return on investment.

“Terex Teleservice telematics allow the owner to monitor the actual condition of the cranes in the fleet, plan maintenance and pre-order the exact required parts,” said Maillot. “It helps maintain uptime and helps reduce spare parts inventory held by the customer. For them that means reduced service costs and increased productivity. It can help with invoicing and even operator training.” A standard platform?The Association of Equipment Manufacturers (AEM) has developed a standard telematics platform for some forms of earth moving and roadway construction equipment, but telematics data related to crane operations are excluded from the AEM’s Draft API standard. Up to now, crane OEMs have approached telematics systems based on their own research, development and customer feedback.

Fendrick doesn’t envision a standard in telematics across all types of construction equipment.

“Cranes have so much information beyond what the dirt equipment generates,” he said. “I think the dirt standards will apply, but the detailed lift information will remain OEM specific.”

Tadano’s Schiller said Tadano would welcome a standard that meets the needs of the crane industry.

“Such a standard would allow owners of cranes from different manufacturers to more easily bring the data into a single monitoring system for their company’s equipment,” Schiller said.

“This would increase the functionality of telematics for the customer, increase the adoption of telematics in the industry and improve the efficiency of operations for our customers.”A standardized option is probably on the horizon, but not for a while, which means crane OEMs will likely move forward with their own customized telematics systems.

Maillot said the envisioned crane data profile as proposed by AEM is a step forward to cover the specific needs of mobile crane users. “Terex would prefer a global teleservice data profile for mobile cranes as this will allow customers to manage mixed fleets,” he said. “We assume that such a standard profile would even include the possibility to additionally handle proprietary data, which are specific for one OEM only.”

Link-Belt has worked closely with both AEM and AEMP on developing a telematics standard and supports this effort, Kabalen said.

“Our stance is that we can meet the standards that are needed today,” he said. “We have developed data points that are very useful to crane operation, such as winch usage and things that apply to a crane’s operation.”

What about data ownership? When it comes to the telematics data collected by OEMs, who owns it and who determines who sees it?Most OEMs agree that the data is owned by the owner of the crane but having access to this data is win-win.

“Some of the benefits of the telematics data for the manufacturer includes managing design and performance improvements on future designs,” said Schiller. “We request and our customer provides us with written consent for our related departments’ (service, quality assurance, development, ICT, etc.) to access this data and use it for development and product improvement purposes. The customer controls who has access to the data. If our customer does not provide us with the consent to confirm their data, we turn off the telematics.”

Schiller said in the early days of telematics in the crane industrythere were some questions, but this has diminished as customers and the industry as a whole have become familiar with telematics on their cranes and other equipment.

“The terms and conditions of use for our platform states that the data is owned by the customer, but by requesting activation, the customer grants Manitowoc the right to see the data,” said Alexander. “Some customers have expressed a concern about the lift/load data being accessed by Manitowoc. In those cases, we suppress the lift/load data so it isn’t sent to our database.”Maillot with Terex said, “Data belongs to the customer who determines access rights for third parties and the OEM.”

Link-Belt has long considered the data to be owned by the crane owner.

“We did that from Day One,” said Kabalen. “The other crane OEMs have followed our lead. We were the first to assure the data is owned by the end user and the interface we use with iCraneTrax allows them to make the choice [whether to share the data with the manufacturer.] We do see owners, when there’s a maintenance issue or a problem in the field, deciding to share that data with us so that we can help diagnose the issue.”