Economic outlook: Energy price impacts on North American construction

16 July 2015

The North American construction market has been hampered by weak oil prices, which have had different impacts on the three economies of Canada, Mexico and the US.

In addition, the US had a dreadful first quarter due to some one-off events - unusually severe weather and strikes at West coast ports - as well as low oil prices compounded by a the strong Dollar. However, the data for the second quarter has been positive, particularly job creation, and IHS Global Insight believes the US economy is poised for moderate growth over the remainder of the year.

In Canada the energy sector is a larger share economy and its weakness will continue to weigh on the construction sector. Oil is also important to Mexico, but more critical is its trade ties to the US, which will improve with the strengthening economy to help offset some of the drag from the energy sector.

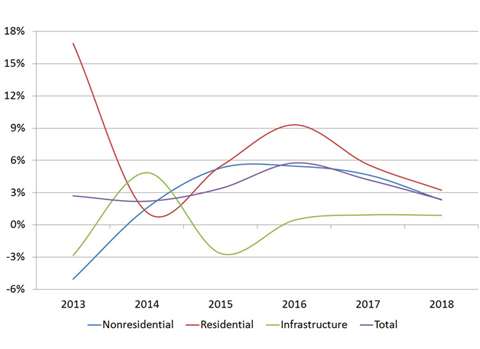

Assessing the degree to which the energy sector has hit US construction markets depends on both the definition and the data source. For example, the US Bureau of Economic Analysis includes mines and oil wells as construction activity; activity IHS Global Insight expects to contract nearly -30% compared to 2014. Given the size of this segment, that would translate into virtually zero growth for US construction.

However, the US Census Bureau construction series excludes mines and oil wells and is expected to grow +2.5% in real terms in 2015, even given the weak start to the year.

The US residential sector is still in recovery mode, with the level of activity some way from typical levels. Housing starts improved to

1 million units in 2014 and are expected to reach 1.1 million in 2015. However, they will not attain the healthy 1.5 million unit range until 2017. Given pent-up demand, we could then see several years of 1.5 to 1.6 million starts from then onwards.

Non-residential

Recent history and the outlook for the non-residential segment is better. The US economy has regained the jobs lost during the crisis years and needs new construction to accommodate further growth. This will see a shift from refurbishment of existing space for new tenants to groundbreaking for new buildings. IHS Global Insight expects double-digit growth in the office, lodging and warehousing segments over the next two years as a result.

Construction linked to retail will not be as strong, as income gains are modest and consumer spending remains cautious. Retail is one segment where the outlook may feature more renovation and less new construction as the segment was overbuilt, and some large national retailers are closing stores or cutting their floor space.

Construction of manufacturing facilities is the weak link in the private sector. The strong US Dollar, combined with weaker growth in key emerging markets will reduce the potential for exports, while improving the affordability of imports. For 2015, industrial construction will be driven by a number of large, ongoing projects, but uncertainty around energy prices and currency exchange will delay new project starts and lead to a contraction in 2016.

The US institutional construction sector offers a mixed outlook. Fiscal restraint is the current policy, and construction of government buildings will be stagnant for the next two years at least.

Health care construction in the US contracted for the past two years, but is set for renewed growth. However, the Affordable Care Act, which will add more individuals to the health care system, and put a focus on preventative care should drive growth.

Fiscal restraint is taking the greatest toll on infrastructure spending with at best low single digit growth over the coming years. The current Highway Bill offers no increases in funding at a federal level, while states’ finances are only improving slowly, leaving little room for investment in infrastructure.

Some modest rebound to street, water and sewer construction will accompany the stronger housing outlook, but the weak energy sector is also limiting opportunities for pipeline and rail expansion.

Canada

Energy production is a larger share of the Canadian economy than for the US, so the oil price decline is taking a larger toll. While improved exports and consumer buying power will keep GDP growth at +1.9% in 2015, both residential and non-residential fixed investment will contract.

Residential investment will fall -1.1%, while non-residential will fall -3.5% with the greatest impact on structural activity. Even with some infrastructure growth, the negative momentum will create a significant contraction in 2015 for construction spending.

But assuming energy prices recover even modestly, investment in Canada’s oil sands projects will become profitable again in 2016, and growth should resume. However, the medium to long term view for Canada is one of quite modest growth.

Energy is vital to Mexico as well, however, the country should see construction growth in 2015. First, low oil prices are a net plus to the US economy as a whole, and Mexico will benefit from the growth in trade which will stem from that (especially at current exchange rates), capital inflows, and remittances.

In addition, while construction linked to stimulus spending will end in 2015, the tail-end effects of previous spending on public infrastructure will support growth.

Oil production has been declining in Mexico regardless of global prices, but constitutional changes will open the hydrocarbon industry to foreign investment which will translate into long-term growth.

In addition, global automakers are investing in substantial new capacity in Mexico, with Toyota now building a new plant in Guanajuato.

The downside for Mexico remains security risks and corruption scandals that are taking a toll on business sentiment and investment.

Outlook

The North American construction market continues to grow, dominated by the US recovery. While Canada poses some short term challenges, these are offset by long term potential from Mexico. Even so, the story will be the US, which will be among the world leaders in construction growth in 2016 and likely into 2017.