GB’s poor start continues

10 May 2018

Bad weather could be behind a fall in Great Britain’s construction output as it continued its recent decline, according to the Office for National Statistics (ONS) with its March 2018 figures.

The ONS said it had received some anecdotal information from a small number of survey respondents about the effect of adverse weather on their businesses in February and March 2018.

It said the adverse weather conditions across Great Britain could have contributed to the decline in construction output, although it added that it was difficult to quantify the exact impact on the industry.

The figures for construction output in Great Britain for March fell by 2.7% in the three-month on three-month series, and it was the biggest fall seen in this series since August 2012.

The ONS found that the three-month on three-month decrease in construction output had been driven by falls in both repair and maintenance, which fell 2.8%, and new work, with a drop of 2.6%.

Following several months of consistently strong growth, private housing also experienced a slowdown in March 2018, contracting in the three-month on three-month series by 1.6%.

ONS figures showed that construction output also fell when compared to the previous month, by 2.3% in March, 2018. The March figures were 4.9% lower than the same month a year ago, and the total for all new work was down 5.2% on 12 months ago.

The UK’s Construction Products Association (CPA) said the ONS figures showed a fall that was broad-based but had been led by an 8.8% decline in public house building activity and a 5.9% reduction in public non-housing work. Private housing output recorded a fall of 1.6% over the quarter.

Rebecca Larkin, senior economist at the CPA, said, “This release confirms what was reported in preliminary GDP (gross domestic product) data – construction had a poor opener to 2018.

“The 2.7% contraction in output was revised up from the initial estimate of a 3.3% decline, but this still represents the weakest outturn since August 2012 and a £1.04 billion (€1.18 billion) loss in output in three months.”

She said that output had declined in each month of the first quarter, “undoubtedly capturing the pauses in work relating to Carillion’s liquidation in January and the snow disruption in February and March”.

She added, “Notably, private housing lost its position as the industry’s star performer, with output falling from a record high, but activity is expected to accelerate as we enter the spring selling season.”

Better news

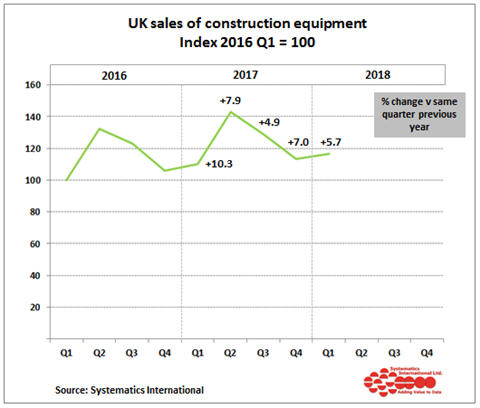

However, there was better news from the UK equipment statistics exchange, which has found that retail sales of construction and earthmoving equipment in the UK market grew by 5.7% in the first quarter of 2018, compared with the same period in 2017.

Last year, the construction equipment statistics exchange was taken over by Systematics International, a specialist data processing company. This scheme is run in partnership with the UK’s Construction Equipment Association (CEA).

The CEA’s Paul Lyons said first quarter figures were encouraging, against the background of a weak construction market in the first quarter of the year.

However, he warned that while equipment sales remained on an upward trend on a quarterly basis, the levels of growth were showing a slowing of momentum. For example, growth in the first quarter of last year exceeded 10%.

The figures showed that the most popular machines in the UK market were mini and midi excavators (up to 10 tonnes), and they showed 8% growth in the first quarter. However, the strongest growth was for telehandlers, the second most popular equipment type, where sales grew by more than 27% compared with the first quarter in 2017.

The CEA said that in spite of facing some difficulties from the bad weather, the housebuilding market remained strong, and continued to stimulate demand for these smaller types of equipment.

Sales of the other major types of construction equipment showed a range of growth rates, the CEA found. Compaction rollers continued to see the weakest sales in the first quarter, continuing the trend seen in 2017. It said a significant factor remained the emphasis by Highways England to spend on smart motorways, which involved less work on carriageways, in favour of safety barriers, drainage and other structures.

The CEA said that fleet replenishment within the rental industry had been a factor, continuing to boost demand in the early months of the year. In the UK market, the rental industry is estimated to account for over 60% of equipment supply, and is more significant than in other European markets.

However, the CEA said that the latest survey by the European Rental Association, published in April, forecast that growth in the UK rental market in 2018 would be only 0.5% for the full year, and would lag behind growth in other major European countries