Mixed feelings on Romanian residential market

27 February 2019

A decrease in demand in the Romanian residential construction market is feared, despite previous indications that the market would be relatively stable – a change that is being attributed to government intervention.

According to research by Dr Sebastian Sipos-Gug of Ebuild, the Romanian member of the EECFA (Eastern European Construction Forecasting Association), the main threat to market equilibrium used to be the oversupply due to speculative development.

He said that much had happened in the past year since the last Ebuild report.

“Residential construction was quite active in 2018,” he said, “and our previous analysis indicated that despite significant growth in the past years, the market could be considered relatively stable. This has changed dramatically due to government intervention at the end of the year through Emergency Government Ordinance No 114/2018 (EGO 114).”

It said there were a number of features of this legislative paper directly and indirectly having an impact on residential construction, including the changing of the minimum wage for construction workers, tax breaks for construction companies, changing the taxation of telecom and energy companies, and a new tax on bank assets.

From 1 January, 2019, the monthly minimum wage for construction workers was raised to RON3,000 (€630), up from RON1,900 (€399) previously, and higher than the RON2,080 (€436.80) for the rest of the economy. The government also included a tax break for these wages in the ordinance, exempt from income and health taxes, yielding a much better net to gross ratio for employees.

Impact on salary

Ebuild said that the total impact on salary costs for companies remained significant.

It said that according to the Employers’ Federation of Building Companies, around 60% of all employees in the construction segment were paid the minimum wage, and so it has been calculated that this would lead to an increase in operating costs of 12% to 15% for construction companies with more than 50 employees – a rise that would be passed onto the market and buyers.

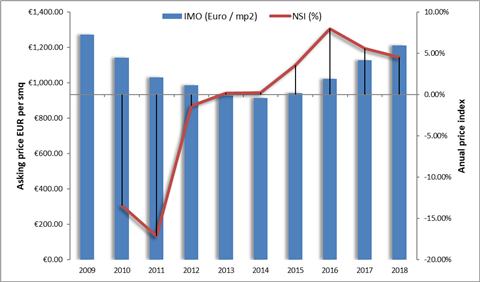

Sipos-Gug reported that after increasing steadily since 2015, residential prices had started to show signs of stalling in late 2018, reaching a growth rate comparable to the one in consumer prices, which he added was leading many to conclude that the end of the current economic cycle was being approached.

With the impact of EGO 114 on construction costs, he said that this balance could be expected to shift once more and prices to continue rising in 2019.

He said that with energy companies paying a 2% tax on their fiscal value, this would normally drive the price up. However, he reported that the Romanian Energy Regulatory Authority (ANRE) had claimed that prices on the regulated (household) market would not change in 2019.

Sipos-Gug said that this would have an impact on energy-intensive activities, which included construction materials manufacture such as steel, cement, bricks and so on.

“The combined effect of higher labour and material costs should drive final residential prices for new construction even higher, and thus the current market equilibrium should switch to a higher price point, resulting in lower demand,” he said.

Another major legal change with a large impact on the market was said to be a new tax on bank assets. Sipos-Gug said that a stress test by the National Bank concluded that this tax would lead, in the best-case scenario, to all banks seeing no profit in 2019.

“Since it is unlikely that banks would take kindly to losing money on the Romanian market,” he said, “one can expect them to move to reduce their assets and/or try to recover their profit margins by making loans more expensive.

“Either way, getting a loan would be more difficult for individuals, especially when talking about mortgage loans that tend to have a high asset value, but a lower interest rate than consumer loans.”

He added that this situation could be amplified by other factors, too.

![Imported from [Romania 1.gif] by [David Shepheard] on [06.11.2009 09:46]](/images//web/g/q/t/70884-romania_1.gif)

“Currently there are heated debates among various political parties, the government, private and public companies, mainly in the fields of banking and energy over the effects of order 114, mitigating its negative effects and perhaps even partly, or completely, repealing it,” said Sipos-Gug.

“There were also concerns voiced from international forums like the European Bank for Reconstruction & Development regarding this piece of legislature,” he added.

However, for now, the government was said to be standing behind it, at least in the short term.

Market freeze

Ebuild felt that from January 2019, the real estate market seemed to freeze slightly. It said home buyers were more timid.

It said it found the Romanian residential market to be in a stalemate. As the market was at a sensitive point, it might all come down to the result of the negotiations between the government and companies on the implementation of EGO 114, it said.

“Despite the negative factors previously discussed,” said Sipos-Gug, “we maintain our previous opinion that a major correction event on the scale of the 2008 one remains unlikely.

“Demand in major cities could sustain the market in the short run, even with higher prices and more difficult access to credit. We do expect the residential market to underperform in 2019 and 2020, and find likely the risk of a small or even moderate correction as the market adapts to the new context.”