UK construction down in Feb

06 March 2019

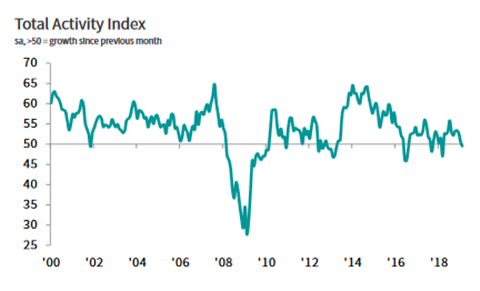

The latest UK Construction PMI report from IHS Markit/CIPS headlines with the first fall in construction in the UK for 11 months.

The report’s seasonally-adjusted figure for February stood at 49.5, down from 50.6 in January; registering below the 50.0 no-change threshold for the first time since March 2018.

While at that time snow disruptions were held largely responsible for the decline in output, the new report attributes this decline to a reduction in the number of commercial building projects – only partially offset by continued modest growth in domestic construction.

Respondents to the survey voiced concerns over the number of new commercial projects available to replace completed or near-completed contracts.

Political uncertainty, in the run-up to Brexit, was also cited as a contributing factor.

Some respondents said they were continuing to employ trainees to alleviate skill shortages, but others said the outlook was too uncertain to replace voluntary leavers.

Looking at the year ahead, there was still positivity among many contractors, but business confidence was reduced significantly when the outlook was reduced to just four months hence.

Other issues cited by respondents included a lengthening of delivery times for products and materials (due in part to shortages of transport availability), as well as marginal cost inflation.

In response to the report, Blane Perrotton, managing director of the national property consultancy and surveyors Naismiths, said, “Suddenly the stagnation of January looks like an achievement rather than a blip.

“The modest growth of residential building has been more than cancelled out by contractions in commercial and infrastructure work.

“For months, investor confidence has been held in a vice-like grip by Brexit uncertainty. Now that uncertainty is translating into falling numbers of new orders and reduced output as builders complete existing projects.

“While the confidence of contractors themselves remains in positive territory – just – their increasing reluctance to hire speaks volumes. Employment growth has tailed off significantly since the end of 2018 as the industry retrenches and digs in for a tough 2019.”

Phil Harris, director at BLP Insurance, said, “The spectre of no-deal Brexit continues to loom large, gripping the industry in a state of trepidation. One very real threat is the visa implications for EU workers post-Brexit.

“The government had tentatively put forward plans to limit long-term visas to those earning north of £30k. In an industry already struggling to attract entry-level recruits and low-skilled labourers, this misguided legislation would be extremely damaging.”

Dr Heather Skipworth, senior lecturer in logistics, procurement and supply chain management at Cranfield School of Management, said, “A supply risk report, due to be published by Dun & Bradstreet and Cranfield School of Management later this month, has found an uncharacteristically high dependency on suppliers in the construction sector…more than 80% of relationships analysed for the report were classified as critical or key, indicating a high reliance on current suppliers and a high level of exposure to supply chain risk.

She added, “The report also found the sector had a very low foreign exchange risk (1.6%), suggesting that construction companies are choosing to work with vendors based in the UK, to sidestep Brexit uncertainty.”