European rental approaches 2020 with caution

28 October 2019

The prospect of an economic slowdown is prompting European rental companies to moderate their investment plans while maintaining similar levels of employment, according to the third-quarter 2019 ERA/IRN RentalTracker – which is jointly organised by IRN and the European Rental Association (ERA).

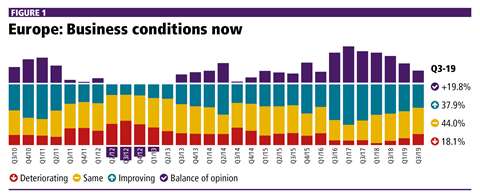

Although the sentiment within the European rental market remains positive on balance, companies are feeling more cautious about the future. The downward trend in the RentalTracker since the first quarter of 2017 has continued into the third quarter of 2019, with the balance figure for current business conditions dipping to its lowest level since early 2016.

The ‘balance’ figure recorded for each question in the survey is the percentage of positive responses less the percentage of negative responses.

In their comments, respondents made reference to economic headwinds and the ongoing uncertainty surrounding Brexit, as well as downward pressure on rental rates.

The survey response rate has remained relatively strong, with more than 115 respondents in the third quarter. (IRN thanks the various rental associations in Europe for their help in distributing the survey.)

Looking at current business conditions across Europe, 38% of respondents said they felt current market conditions were improving, which is down from the 44% recorded in the first quarter of the year. This positive response was counterbalanced by 18% of respondents who saw a deterioration – compared to 12% in the previous survey – giving a positive balance of 20%. This is a significant drop from the balance of 32% recorded in the first-quarter 2019 ERA/IRN RentalTracker.

The perceived slowing of the market is mirrored by the general perception of lower year-on-year growth, when comparing the third quarter of 2019 with the equivalent period in 2018.

Taking Europe as a whole, 47% of respondents reported year-on-year growth, representing a drop from the 52% recorded in the previous RentalTracker six months ago. Also, the overall balance figure for year-on-year growth came to 36%, which is below the 42% recorded in the first quarter of 2019 and continues the downward movement since the record 58% reported in the third quarter of 2018. In fact, the latest balance figure for year-on-year growth, although positive, is the lowest since the first quarter of 2016.

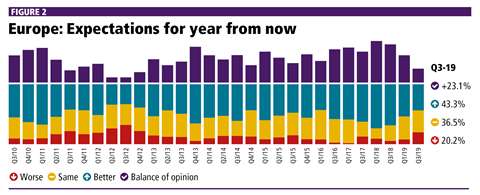

What are rental companies thinking about business conditions a year from now? There was a positive balance of 23% of respondents expecting market conditions to be better in the third quarter of 2020. This is a significant drop from the 45% recorded in the previous RentalTracker, as well as the 62% in the third quarter of 2018.

Compared to the first quarter survey, there was a shift from positive to negative responses, with 43% expecting greater activity, compared to 53% six months ago, and 20% forecasting worse conditions, compared to 9% in the previous survey. Meanwhile, the proportion of companies expecting business activity to be the same remained largely unchanged.

Overall, European rental companies remain optimistic about future business conditions, but are making preparations for a possible softening of the market.

A full analysis of the third-quarter 2019 RentalTracker will be featured in the November-December issue of IRN.