Rental Confidence Survey: Stability for 2017

10 January 2017

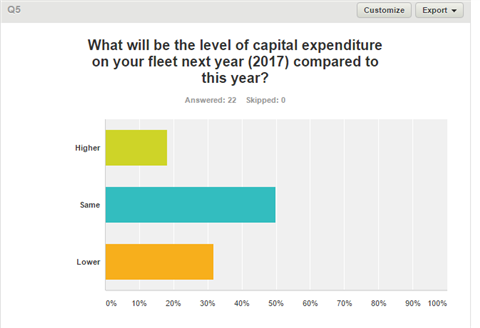

what will be the level of capital expenditure on your fleet next year (2017) compared to this year?

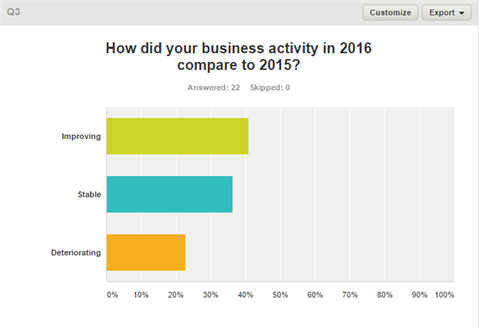

Nearly half (47 per cent) of respondents in this year’s crane rental confidence survey said that business conditions in their area of the crane rental market were stable, with the remaining respondents equally split between improving and deteriorating (27 %).

Business activity around the world is improving. Just over 40 % of respondents claimed that business activity in 2016 was better than in 2015, while 36 % felt that activity had been stable over this period. In some areas, however, of the Asia Pacific, South America, Europe and the CIS regions, 24 % reported that business had deteriorated.

Looking forward to 2017, 32 % said that they thought business levels would improve while the majority thought levels would remain stable.

Following a downturn from last year’s survey, 32 % of respondents claimed that they would be reducing their levels of capital expenditure for 2017 compared to just 14 % from last year. These responses came from companies mainly in the Asia Pacific and Central/South America regions. Almost half, however, of all respondents said that capital expenditure would remain the same, with the majority of those choosing this bracket based in Europe and North America.

Over the last twelve months, there has been some major fleet expansion. USA-based Maxim Crane Works continued its steady expansion by acquiring the core fleet of crawler cranes from Essex Crane Rental Corp. In addition, the company acquired branch facilities across several states in the USA.

Bryan Carlisle, CEO at Maxim Crane Works, said, “Maxim Crane is committed to strengthening its position as a true coast-to-coast lifting solutions provider to all of our customers. These new locations enable Maxim to offer full service operations in areas that we have previously covered on a project basis.”

The company has also completed the merger of AmQuip Crane Rental and its affiliated companies. Maxim now has 46 branches and more than 2,500 cranes.

Most recently, Middle East logistics provider Integrated Logistics based in Ahmadi, Kuwait, took delivery of a new Demag

CC 3800-1 crawler crane, 20 Terex AC 100/4L all terrains and 10 Terex Explorer 5600 all terrains. The new cranes will join a fleet of more than 2,000 machines to be used throughout the Middle East and North Africa.

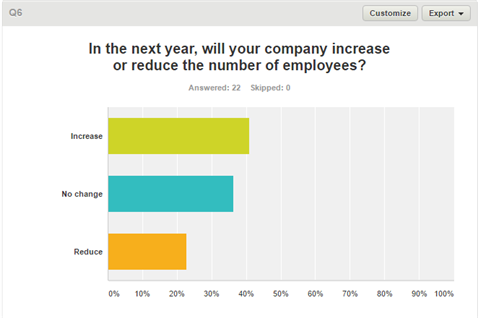

in the next year, will your company increase or reduce the number of employees?

India saw fleet expansions too with Mumbai-based crane rental company Amrik Singh & Sons, who took delivery of a new 650 tonne Sany crawler crane on show at Bauma, China last year. Between June and November of 2016, the company received four 650 tonners and will be taking delivery of another later this month. All the cranes are working on or destined for wind turbine erection projects in India.

For fleet expansion and investment, this was a positive area of the survey with almost 41 % of companies claiming they would be increasing the number of their employees. While 36.4 % would be staying the same. Although, for several companies (23 %) in Central/South America and in the Asia Pacific, there was a forecast of employee numbers decreasing in 2017.

Rental rate changes

Nearly 16 % said that changes in rental rates for 50 tonne capacity wheeled mobile cranes had increased over the past 12 months, while 68 % said it remained the same and nearly 16 % said it was lower.

Almost 12 % said that rental rates for 100 tonne capacity wheeled mobile cranes were higher over the past 12 months, while 65 % said they were the same and 23.5 % said it was lower. Around 6 % said that the rental rate for 150 tonne capacity wheeled mobile cranes had increased over the past 12 months, while most respondents said that it would remain the same (70.6 %) with 24 % saying it was lower. Just over 13 % said that the rate for

70 tonne capacity crawler cranes had increased over the past 12 months, while 60 % said it remained the same and 27 % said it was lower.

In the 150 tonne capacity crawler crane segment 14 % said that rental rates had increased over the last 12 months, while half said rates remained the same and nearly 36 % said it was lower.

Nearly half of the respondents (49 %) said that rental rates for 100 tonne-metre tower cranes had increased over the past 12 months, 39 % said it was the same and 12 % reported it as being lower.

For 300 tonne-metre class tower cranes 40 % said that rental rates had increased, while 46 % said the rate had remained the same and 14 % said it was lower.

Rental rate forecast

Only 11 % of respondents forecast that rental rates for 50 tonne capacity wheeled mobile cranes over the next 12 months would increase, while 83 % said they would stay the same and 6 % said they would be lower.

Around 19 % forecast that rental rates for 100 tonne capacity wheeled mobile cranes over the next 12 months would increase, while 75 % said they would stay the same and 16 % said they would be lower.

Nearly 18 % forecast that rental rates for 150 tonne capacity wheeled mobile cranes over the next 12 months would increase,

76 % would remain the same while 6 % said they would be lower.

A total of 27 % forecast that rental rates for 70 tonne capacity crawler cranes over the next 12 months would increase, while 53 % said they would remain the same and 20 % said they would be lower.

Around 29 % forecast that rental rates for 150 tonne capacity crawler cranes over the next 12 months would increase, while half said they would stay the same and 21 % said they would be lower.

Similarly, 29 % forecast that rental rates for 100 tonne-metre tower cranes would increase over the next 12 months, while 69 % expect rates to stay the same and 2 % believe they will be lower.

Close to 28 % forecast that rental rates for 300 tonne-metre tower cranes would increase over the next 12 months, while 71 % said rates would stay the same and only just over 1 % said rates would be lower.

Fleet time utilisation

Overall, only 18 % of respondents said that they felt that fleet time utilisation was improving, while 55 % said it was stable and 27 % said it was deteriorating.

Looking at the next 12 months, 22 % of respondents felt that utilisation rates for 50 tonne capacity wheeled mobile cranes would increase, while just over 60 % said they would stay the same and 17 % expected that they would be lower.

For 100 tonne capacity wheeled mobile cranes, nearly 12 % said that utilisation rates would increase, while more than 60 % said they would stay the same and nearly a quarter said they would be lower.

For 150 tonne capacity wheeled mobile cranes, nearly 20 % said that utilisation rates would increase, while 65 % said they would stay the same and nearly 18 % said they would be lower.

For 70 tonne capacity wheeled crawler cranes, 20 % of respondents said that utilisation rates would increase, while 53 % said they would stay the same and 27 % said they would be lower.

For 150 tonne capacity crawler cranes, 15 % said that utilisation rates would increase, while just over 60 % said they would stay the same and 23 % said they would be lower.

For 100 tonne-metre tower cranes, 15 %

said that utilisation rates would increase, while 71 % said they would remain the same and more than 13 % said they would be lower.

For 300 tonne-metre tower cranes, 14 % of respondents said that utilisation rates would increase, while nearly 60 % said they expected them to remain the same and 29 % said they will be lower.