ConExpo: What’s the outlook for the US construction equipment market?

13 March 2023

North America’s biggest construction trade show ConExpo-ConAgg 2023 gets underway this week (14-18 March), with 1,800 exhibitors showing off their products in Las Vegas.

The show was one of the last major industry events to take place before the Covid-19 lockdowns put a prolonged halt to in-person gatherings.

A lot has happened since then, not least the continued fallout from the pandemic and the war in Ukraine.

That has precipitated a change the economic landscape in the US.

So where does the US construction equipment market stand now, as Conexpo-ConAgg kicks off once again?

Record 2022 gives way to ‘mild recession’

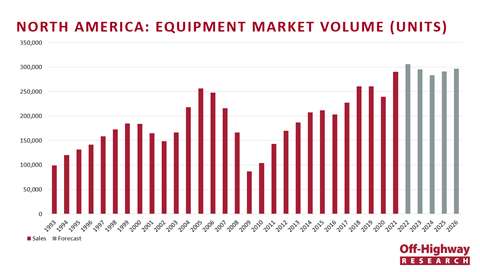

The show comes off the back of a record year in 2022, in terms of the number of machines sold in North America, according to Off-Highway Research’s managing director Chris Sleight.

Interest rates fell following the arrival of the coronavirus pandemic, sparking an explosion in residential building.

“There was a lot more household income around because there was good job and wage support, even though a lot of people got fired. All that spare money not being spent on holidays or services encouraged people to extend their existing properties or to move to bigger places. What that did in terms of construction equipment is really grow the sales of these smaller equipment types,” explains Sleight.

That resulted in a spike in the sort of compact equipment needed for residential construction work. Mini excavator sales enjoyed a boost, and there was a large increase in the number of compact tracked loader sales too, although these came at the expense of skid steer loader sales to an extent.

But by the middle of 2022, as interest rates started to rise again amid high inflation, residential construction started to cool. The number of building permits started to flatten off and as a result, Sleight expects to see a “mild recession” in the US in general in 2023. That means a slowdown, if not a fall, in the sale of compact machines in 2023 and 2024, which is expected to drag overall market volume by number of units down.

Increased infrastructure spending

Despite the cooling off in the residential market, money from President Joe Biden’s Infrastructure Investment and Jobs Act (IIJA) is expected to start to reach projects on the ground, two years after the bill was voted through.

Construction equipment market volume (by units) in North America (Source: Off-Highway Research)

Construction equipment market volume (by units) in North America (Source: Off-Highway Research)

Off-Highway Research suggests that as much as $60 billion will be released in the 2023 financial year.

While the money will help, particularly when it comes to the sale of heavy, higher-value machinery, Sleight doesn’t expect it to generate a large spike in orders.

He says, “Our feeling is about the IIJA is that it has a very broad definition of infrastructure and a lot of it is not physical or doesn’t have a construction equipment component to it. The amount of extra work probably totals $50-100 billion over a span of years. The US construction market is $1.8 trillion per year. Obviously, that amount of money spread out over 5-10 years really doesn’t move the needle that much.”

Nonetheless, where the IIJA will help is by providing more certainty on infrastructure spending in the US over a longer timeframe.

Sleight explains, “That gives people certainty to invest in fleets because they know there is funding in place over a 5-10-year horizon, so they can buy a machine which has 5-10-year lifespan, comfortable that there is going to be work for it. So we expect the sales of heavier equipment not necessarily to explode but to certainly be a little bit better.”

Still a housing shortfall

Over the slightly longer term, Sleight also expects US housebuilding to rebound.

“There was a very long period in the early 2010s, following the sub-prime crisis and global financial collapse where US housebuilding was on the floor. That 10-year period where the US wasn’t building enough houses has not really been compensated for even by the spike that we have now seen. There is still a shortfall of 3-6 million houses in the US, so housebuilding will come back,” he says.

That, combined with the effect of the IIJA, should lead to the number of construction equipment units sold in North America increasing again in 2025 and 2026 after the declines of the two preceding years.