Rapid tech adoption and optimism at heart of global construction

08 June 2023

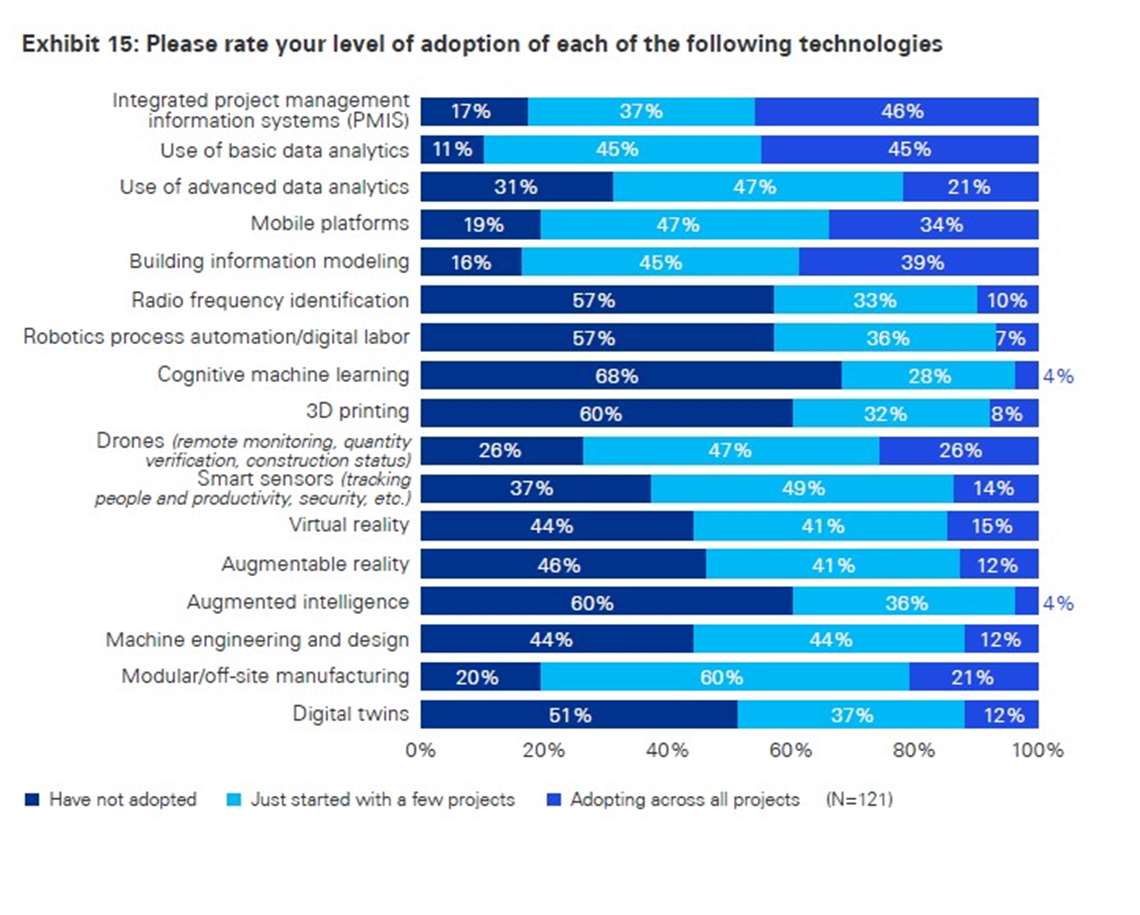

The companies that make up the global construction ecosystem are increasingly investing in new technology, with 81% of engineering and construction firms saying that they have adopted or are starting to adopt, mobile platforms and over a third of respondents using artificial intelligence (AI), according to KPMG’s 2023 Global Construction Survey.

The popularity of AI is continuing to grow, with 37% of respondents saying they were either adopting or just starting to adopt the use of AI (up from 23% in 2018 and 29% in 2021) – in the form of digital twins, smarter construction equipment, data and document management, and enhanced safety and communication. Comfortably over a third of respondents (43%) are either using or starting to use Robotic Process Automation (RPA) – up from 10% in 2017.

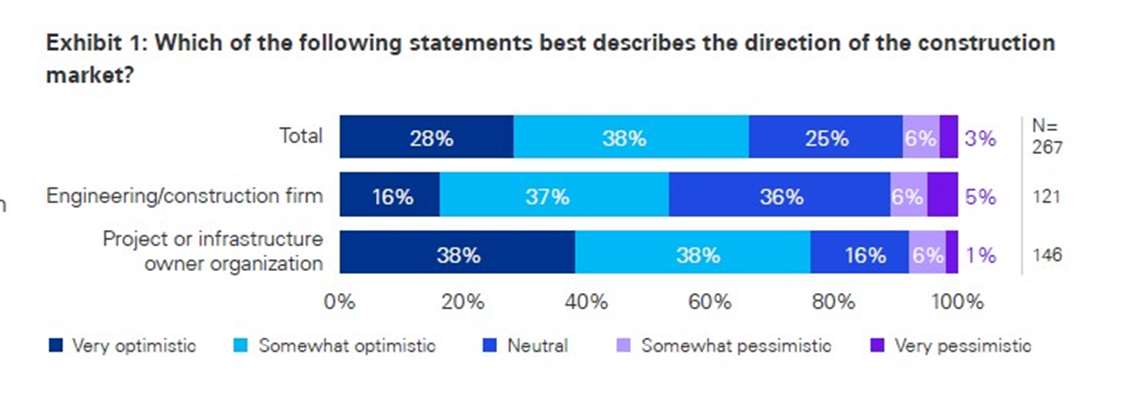

The survey also revealed that the industry is cautiously optimistic, despite facing ongoing volatility, including continued supply chain disruption, rising inflation and a possible recession. This positivity is due to a significant post-Covid-19 pipeline, government infrastructure funding, and environmental, social, and governance (ESG) demands driving renewable energy and circular economy projects.

Two thirds of respondents (66%) said they are optimistic about the direction of the construction industry with 38% of project owners being “very optimistic” – in comparison to just 18% in KPMG’s 2021 survey.

Four out of ten engineering and construction respondents expect revenue growth of more than 10% in the next 12 months. Over half (54%) of respondents can fully envisage the benefits of ESG investments and are making improvements.

Two thirds of respondents (66%) said they are optimistic about the direction of the construction industry

Two thirds of respondents (66%) said they are optimistic about the direction of the construction industry

Despite this positivity, the after-effects of Covid-19 are still apparent and the industry is continuing to face a number of challenges, with continued supply chain disruption, high energy and materials prices, and labor shortages pushing up costs and delaying project timelines. Just under half (45%) of project owner respondents say they have experienced a pandemic-related schedule delay or cost impact of more than 20%.

The sector continues to struggle with poor project performance, with 37% of respondents revealing that they have missed budget and/or schedule performance targets due to lack of effective risk management and that only half of project owners’ projects are meeting completion deadlines – a rise of 5% since the 2021 survey.

The rising influence of ESG in construction

The companies that make up the global construction ecosystem are increasingly investing in new technology

The companies that make up the global construction ecosystem are increasingly investing in new technology

In KPMGs first Global Construction survey in 2008, respondents revealed that the number one driver for sustainability amongst E&C companies was to position themselves as “environmentally aware” - this was cited by 56% of respondents.

This year’s report notes that ESG has become a more important and integrated part of leaders’ thinking, with 54% saying they fully envisage the benefits of ESG investments and are making improvements in this area. Half of E&C companies see the opportunity to gain a competitive edge through investing in ESG initiatives, suggesting that leaders are beginning to grasp the value of embracing ESG more fully.

In a nod to the importance of strong sustainability credentials to satisfy investors, the survey also found that 32% of project owners recognise the need to integrate ESG into both their projects and reporting in order to enhance access to capital to fund their projects.